While 2020 was a hot year for mining mergers and acquisitions (M&A), the price boom is over and values are returning to normal, according to data collected for Business in Vancouver’s Biggest B.C. Mining Mergers and Acquisitions of 2021 list (https:biv.com/lists).

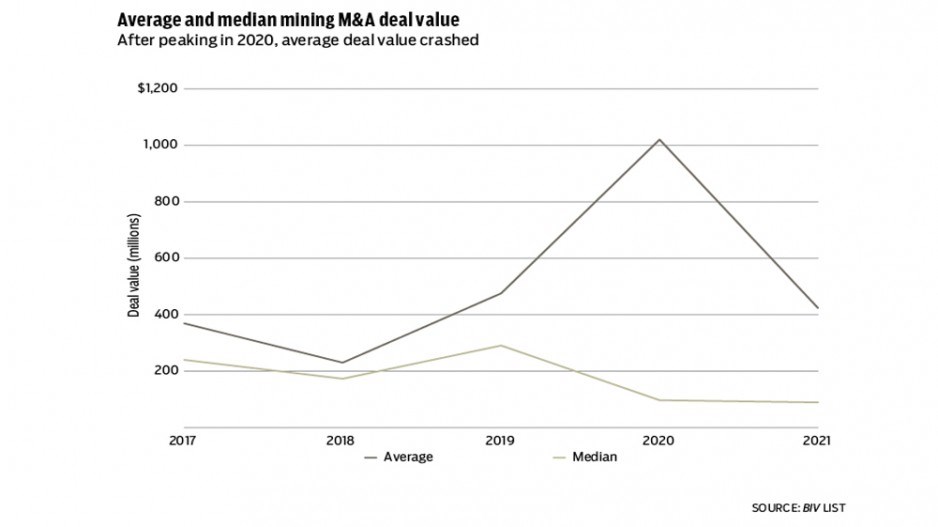

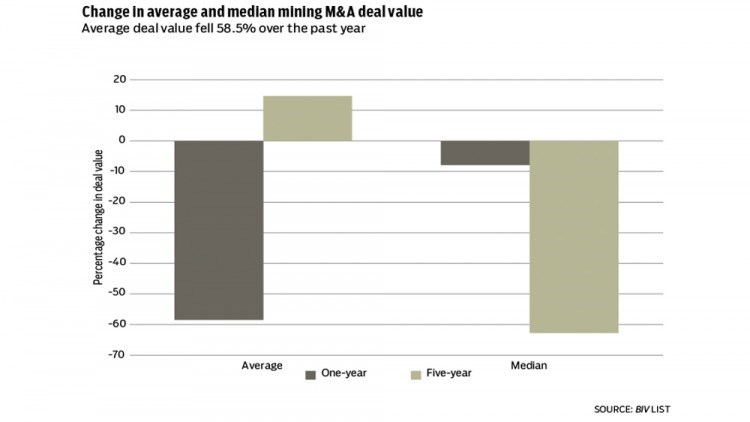

In 2020, the average value of mining M&As spiked 114.5% to over $1 billion from $475 million the year before. Prior to 2019, average deal size had hovered between $200 and $500 million. However, in 2021 prices normalized, falling below 2019 levels to $423.5 million in a decline of 58.5%.

In 2020, there were four deals worth over $1 billion, with the top M&A valued at $13.3 billion – Newmont’s (TSX:NGT) acquisition of Goldcorp. In 2021, there were just two transactions valued at over $1 billion. The largest deal was the merger between Capstone Mining (TSX:CS) and Mantos Copper, valued at $4.26 billion.

Despite the significant value variance of the top deal in 2020 versus 2021, the size of the smallest deals in both years were both valued at roughly $9 million.

While the average deal size spiked in 2020, the median M&A value crashed 66.6% to $97.1 million in 2020 from $290.9 million in 2019. Last year, the median deal value continued to fall by 7.9% to $89.4 million. This suggests that while the value of larger deals posted a one-year spike in 2020, smaller deals have shown a decline in value for two consecutive years. •