“Silicon chip production is in the hands of only a few,” says Wolf Richter, chief technology officer of Vancouver startup Epic Semiconductors Inc.

With only a narrow range of facilities capable of manufacturing semiconductors – chips critical to the function of electronic components embedded in everything from smartphones to cars – the current global shortage is hampering everything from research and development at tech companies to the availability of consumer goods.

Most of the world’s semiconductors are manufactured in Taiwan, but Ukraine and Russia are both major sources of the neon and palladium gases used in the manufacturing of the chips. Russia’s invasion of Ukraine did not cause the current supply crunch but it is worsening it.

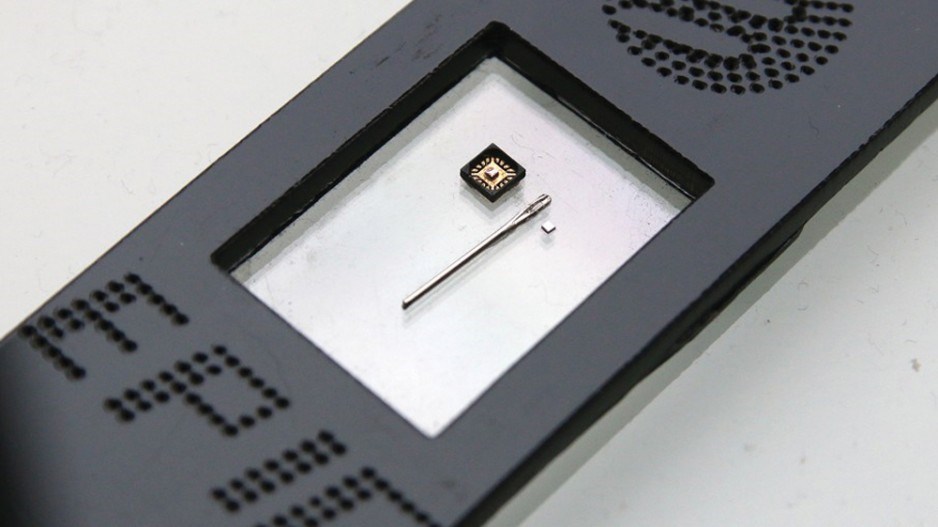

In the case of Richter’s B.C. company, manufacturing doesn’t rely on any third-party components, and the chips are produced using a variation of a laser printer tapping specialized ink.

Richter said the advent of such chips means it would even be possible to manufacture semiconductors on home printers using a kind of flexible foil. It’s a prospect that would make businesses and markets less reliant on a small number of manufacturers amid geopolitical uncertainty.

“With few chips to spare, R&D teams are left without resources to innovate future models and perform necessary testing to bring new items to market. A company may find ways to stock up and sustain, but the larger impact is the effect on innovation,” said Matthew Putnam, CEO of software firm Nanotronics Imaging Inc., which provides services to the semiconductor industry.

“There is no telling how long this shortage will last.”

On the consumer side, would-be buyers of electric vehicles, TVs, smartphones, computers and even gaming consoles such as the PlayStation 5 are facing higher prices amid the constrained supply of the chips necessary to make those products.

Even modern dishwashers and coffeemakers need semiconductors to function.

An April report from business services firm Deloitte forecasts the semiconductor industry growing 10 per cent this year to more than US$600 billion.

But with this growing demand for chips comes a labour crunch as more manufacturers try to launch new facilities.

Deloitte estimated there were about 510,000 workers in semiconductor design and manufacturing based in China as of 2019. But by the end of this year, China will be facing a shortfall of 250,000 such professionals.

The U.S. is home to 280,000 semiconductor workers, while new chip plants in Texas and Arizona are set to create 5,000 more manufacturing and engineering jobs.

“Even as domestic chip companies are experiencing engineering and manufacturing talent shortages, they are also facing competition for talent from other tech majors aggressively expanding in high-growth areas,” the Deloitte report said.