While the province continues to take action to cool the housing market, the original target of government intervention has been quietly sticking to the sidelines.

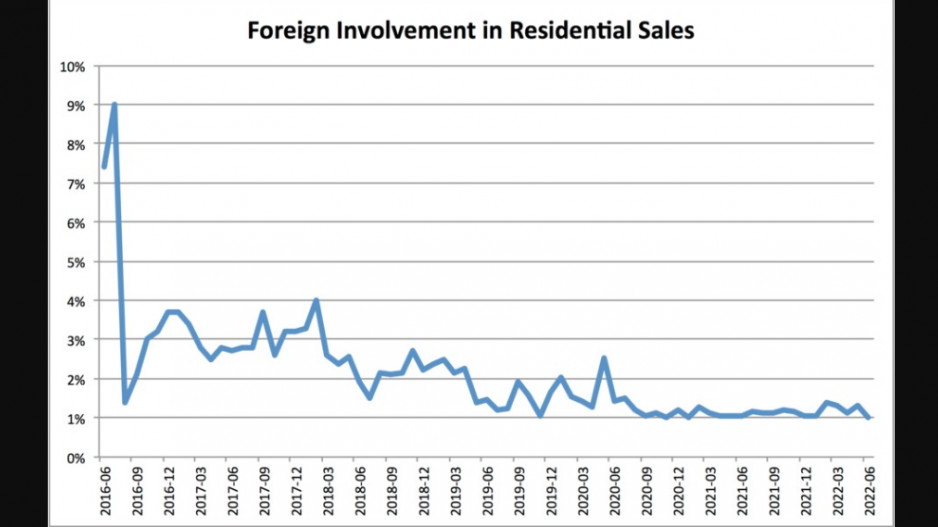

The latest round of property transfer tax data released by the BC Ministry of Finance shows that foreign buyers accounted for a record low proportion of residential transactions in June at just 1 per cent. This is consistent with a downward trend seen even before the pandemic, when international borders shut to foreign travellers and potential purchasers.

The proportion of residential transactions with foreign involvement has not been above 1.5 per cent since July 2020 nor has the proportion been consistently above 2 per cent since April 2019.

The low level of activity is a shift from July 2016, when the province reported that foreign nationals were involved in 9 per cent of residential transactions and began charging those buyers an additional property transfer tax of 15 per cent of transaction value.

Popularly known as the foreign buyers’ tax, it had a short-lived chilling effect on transactions. Residential transactions fell to 1.4 per cent of all residential sales in August 2016 before normalizing to a level of three to four per cent for the duration of 2017. When the new BC NDP government raised the additional tax to 20 per cent in February 2018, the rate fell below three per cent and stayed there even as sales surged as the economy reopened.

Sorted by municipality, the latest figures indicate that Surrey, Richmond and Vancouver are the top municipalities for foreign buyers of residential real estate. Surrey saw 84 residential transactions involving foreign buyers in the first half of this year, followed by Richmond with 64 and Vancouver with 44.

Of the 11 jurisdictions reporting residential sales involving foreign nationals, Whistler is the only one outside Metro Vancouver. (When other types of transactions involving foreign buyers are included, Ashcroft also figures.)

The relatively low percentage of foreign buyers now active in the market underscores that the tight market hinges more on a lack of supply than competition from those who wish to park capital here.

“It is clear that there are still many foreign buyers willing to buy Vancouver and BC real estate,” wrote Marc Lee of the Canadian Centre for Policy Alternatives in a briefing note earlier this year.

While implementation of the tax has been successful in limiting foreign involvement while adding to government coffers – Lee describes it as “a win-win” – affordability and supply remain challenges.

Underscoring this is provincial data regarding first-time buyers.

During the first half of this year, first-time buyers accounted for 4,426 residential purchases. That’s a 46 per cent decrease from the same period last year, when first-time buyers made 8,130 purchases.