It has been nearly a decade since the Sukunka metallurgical coal mine proposal near Chetwynd and Tumbler Ridge was first pitched to the BC Environmental Assessment Office.

The project, estimated to cost $450 million to build, is still in play, and the project will soon enter a final review by the BC Environmental Assessment Office (EAO).

The clock has been stopped on the review several times to allow the company to respond to numerous questions and concerns raised about environmental impacts – from impacts on fish to greenhouse gas emissions and impacts on caribou habitat.

The company behind the project is Glencore Coal Assets Canada, a Canadian subsidiary of the multi-national mining major, Glencore Plc.

An EAO application review resumed last week, following the lifting of a suspension that was granted to Glencore to continue discussions about the Southern Mountain Caribou.

On August 2, the BC EAO will begin a public comment period on a draft assessment report and proposed environmental assessment conditions for the proposed mine.

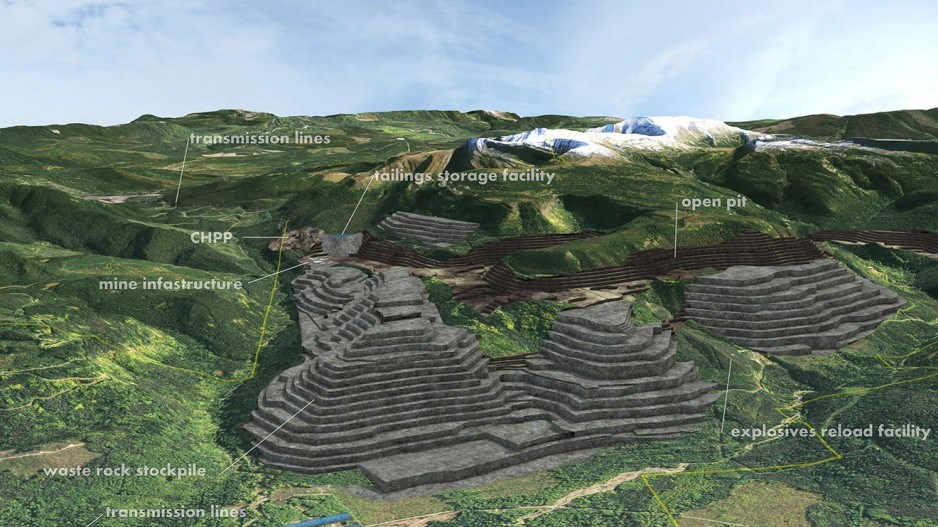

The Sukunka project – a proposed open-cut metallurgical coal mine -- was first pitched to the BC EAO in 2013 by a former owner, Xtrata Coal Co.

It was originally rejected by the BC EAO for a review due to a “lack of detail related to mine planning, geotechnical information, geochemistry and water quality predictions.”

Glencore resubmitted an application, providing the details required, and the project formally entered the EAO process in 2015.

The mine would produce about 3 million tonnes of steelmaking coal annually, with capacity for expanded production, and would have a mine life of 20 years. Unlike thermal coal, which is burned to generate electricity, metallurgical coal is used to make steel.

From the beginning, concerns about the mine’s impact on the Quintette population of Southern Mountain Caribou was a concern, and the project received a number of suspensions, with the EAO hitting the pause button several times to allow the company to address various environmental concerns and consult with First Nations.

The West Moberly, Saulteau, and McLeod Lake First Nations commissioned their own impact study to assess the mine's environmental impacts. A major concern for First Nations in the area is the mine's impact on Southern Mountain Caribou, which have been in a long-term decline and are listed as a “threatened” species.

The three First Nations, as well as the Doig River First Nation, opposed the EAO’s lifting of the suspension on the review, saying impacts on caribou have still not been fully addressed.

In February, they also raised the concern about “cumulative impacts.”

All four First Nations are signatories to Treaty 8. Last year, the BC Supreme Court ruled in favour of the Blueberry River First Nation – also a Treaty 8 signatory – which claimed decades of industrial development in their territory constitutes a breach of treaty rights. That has put a temporary halt to some industrial activities in the Peace region.

In a letter in February, the four First Nations urged the EAO to keep the Sukunka review paused until their concerns were further addressed.

“Given that the project will only exacerbate these already extensive cumulative impacts and infringements, it is not appropriate for the EAO to lift the suspension,” they write in their letter to the EAO.

Since the project was first accepted for an environmental review, a new caribou recovery plan for the area has been created.

Another new wrinkle not anticipated by the company to be part of the environmental review was greenhouse gases, which the B.C. Climate Action Secretariat began asking about, after the project passed its initial review.

All mines produce some greenhouse gas emissions, but coal mines in particular can be the source of fairly significant amounts of methane, which has a high global warming potential, compared to CO2.

The GHG intensity of major projects weren’t a formal consideration when the Sukunka mine started the EAO review process.

Glencore noted that questions raised about GHG emissions occurred after the initial 180-day review period, so it had not been part of original information requests.

These information requests arise from the initial review and public comment period, in which the proponent is required to respond to questions about various environmental impacts, and suggest mitigation measures.

Glencore took issue with the GHG issue being raised after the formal review period, which is when those questions are supposed to be raised.

“Glencore is respectfully seeking additional justification as to why the EAO is allowing ‘new’ comments on the content of the application to be received 11 months after it was accepted for review,” the company wrote in 2016.

“Being required to respond to these comments at this stage of the review process seems to be inconsistent with the EAO’s Fairness and Service Code, especially when no prior acknowledgment of these potential outstanding information requests was provided.”

Nevertheless, despite its objections, Glencore responded by commissioning Stantec to do a GHG life cycle analysis.

The Stantec report estimated the Sukunka mine would account for 16% of all emissions produced from coalmines in B.C. -- a total of 259,648 tonnes annually of CO2 equivalent, of which methane would constitute 63,289 tonnes annually.

The project is estimated to add 2% to B.C.’s total emissions by 2050.

"Project GHG emissions will change the BC GHG targets for years 2020 and 2050 by 0.6% and 2% respectively," the Stantec report notes. "It should be noted however, that the project is expected to be completed within 20 years of commencement, and as such is unlikely to contribute to the BC GHG targets for 2050."

Asked by the EAO if coal bed methane could be captured, Glencore, through Stantec, responded that it was possible, “but that it is not financially feasible.”