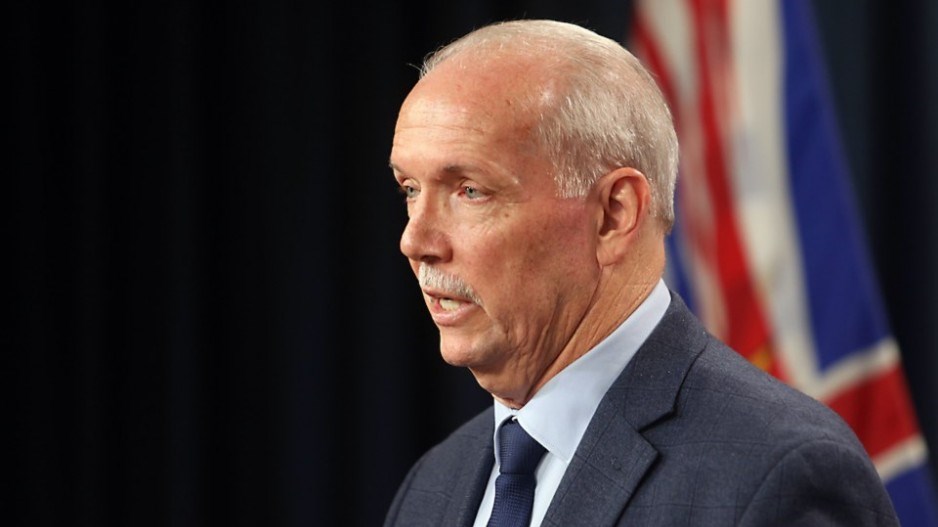

Families will receive a financial boost worth up to $1,500 each and rent increases will be capped next year to help those feeling the squeeze of global inflation, Premier John Horgan announced in Langford Wednesday afternoon.

The support measures to combat the rising cost of living and interest-rates hikes include a one-time increase next month to the Climate Action Tax Credit for low and moderate income earners, an increase January through March to the B.C. Family Benefit, and a two per cent cap on rent hikes in 2023.

“We’ve been experiencing unprecedented inflation, not just here in British Columbia, but indeed internationally,” Horgan said at the Goudy Field sports stadium, while kids played soccer in the background.

“Families are seeing it in the grocery store, we certainly see it at the pumps, where we’ve seen a 35 cent drop in gas prices and still they remain unacceptably high for most British Columbians.”

The pandemic and war in Ukraine have “put us all collectively in a difficult spot,” he said.

Measures announced by the province include:

• In October, the maximum amount for the Climate Action Tax Credit will be increased for low- and moderate-income British Columbians by up to an additional $164 per adult and $41 per child, meaning a family with two children can could receive up to an additional $410.

• In January, February and March, the B.C. Family Benefit will increase by as much as $58.33 per child each month, meaning a family with two children will receive up to $350

• Rent increases will be capped at two per cent for 2023. The province says it recognizes that landlords are facing the same inflationary pressure and is committed to ensuring that landlords can make the necessary repairs and upgrades to their rental units.

B.C. residents do not need to apply for the enhanced Climate Action Tax Credit and B.C. Family Benefit — if their income-tax filing is up to date, they will automatically receive the temporary increases.

Horgan said the cheques will be coming out in the first week in October.

The government is also working with B.C. Hydro on an additional cost-of-living measure that will come later in the year, said Horgan.

The announcement comes as the Bank of Canada posts another interest-rate hike — three quarters of a percentage point, with the rate rising to 3.25 from 0.25 at the start of the year — in an attempt to rein in runaway inflation.

Last week, the province said its projected $9.7-billion budget deficit is now a $1.3-billion surplus.

It announced a $60-million a Student and Family Affordability Fund to help school districts ensure students are fed and have the school supplies they need for the year.

Among Island school districts, funding amounts range from $250,000 in the Gulf Islands, Vancouver Island West and Vancouver Island North to almost $2 million in Greater Victoria.