North American stock markets were up slightly before the U.S. Federal Reserve announced that it would hike interest rates by 75 basis points.

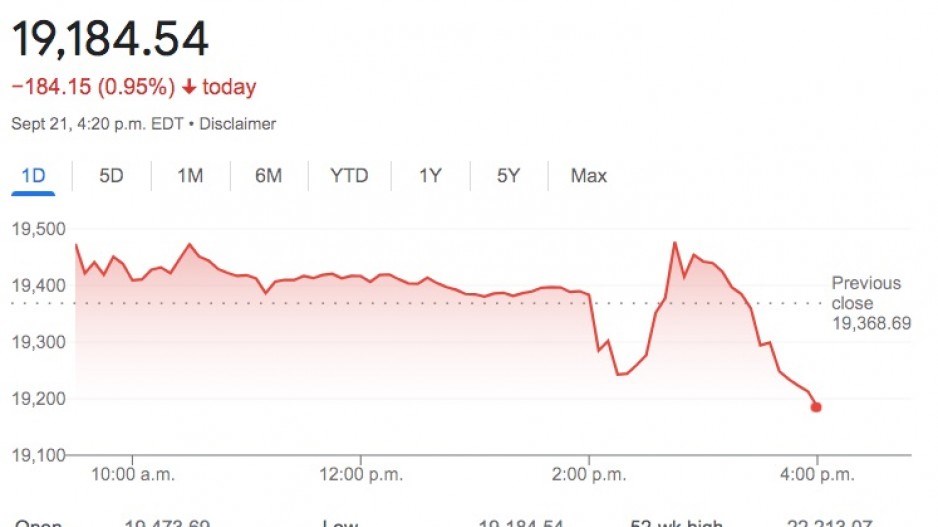

Stock markets then fell, then rose above pre-announcement levels and then plunged to the lowest level of the day.

In the end, the Toronto Stock Exchange declined 184.15 points, or 0.95 per cent, to 19,184.54 points. The S&P 500 dropped 66 points, or 1.71 per cent, to 3789.93, while the Nasdaq fell 204.86 points, or 1.79 per cent, to 11,220.19 points and the Dow Jones Index erased 522.45 points, or 1.7 per cent, to 30,183.78.

Canadian stocks reacted in a virtual mirror image of those south of the border because the Bank of Canada's approach to monetary policy tends to resemble that of the U.S. Federal Reserve. The two countries' economies are also inextricably linked.

Analysts expected U.S. Federal Reserve chair Jerome Powell to raise interest rates by 75 basis points, bringing the federal funds rate to the range of three per cent and 3.25 per cent – the highest since 2008.

What may have created some of the market volatility was information on a newly released dot plot. It showed many Fed officials see the federal funds rate rising next year to 4.9 per cent – higher than many analysts had expected. Most Fed officials expect rates to rise above 4.5 per cent next year, with six forecasting that the so-called "terminal rate," or peak, will be 4.9 per cent. Earlier this morning, the analyst consensus tended to be that the Fed would hike rates to a peak of 4.5 per cent, before reducing them to four per cent by the end of next year.

"Today’s messaging didn’t deviate significantly from chair Powell’s hawkish [Aug. 26] Jackson Hole speech, in which he emphasized further rate hikes to come and said restrictive monetary policy will be needed for some time," RBC Economics senior economist Josh Nye said in an afternoon research note.

He suggested that the Fed may not deliver the interest rate hikes that it identified in its dot plot but that RBC's forecast for the U.S. federal funds rate to peak at between 3.75 per cent and four per cent later this year are now "tilted firmly to the upside."

Nye said he expects sluggish economic growth in the second half of 2022, and lower inflation "will allow the Fed to pause its tightening cycle in 2023."

Nye expects a mild recession next year.