Oil prices and demand have been a rollercoaster over the past few years, first hitting a roughly 20-year low in April 2020 and then hitting a 10-year high in May 2022. However, that rollercoaster ride looks to be coming to an end as demand for oil flattens and begins trending down, according to a new report from the Pembina institute.

“For the first time, a range of credible institutions, including from the oil sector, agree that we are heading for a near future of reduced demand for oil,” said Janetta McKenzie, senior analyst at the Pembina Institute and author of the report. “The question is only the scale and pace of that decline. And, unlike in the boom-and-bust cycles of the past, this decline is based on significant, long-term social and economic trends – meaning demand is projected to start falling during this decade, and is unlikely to resurge.”

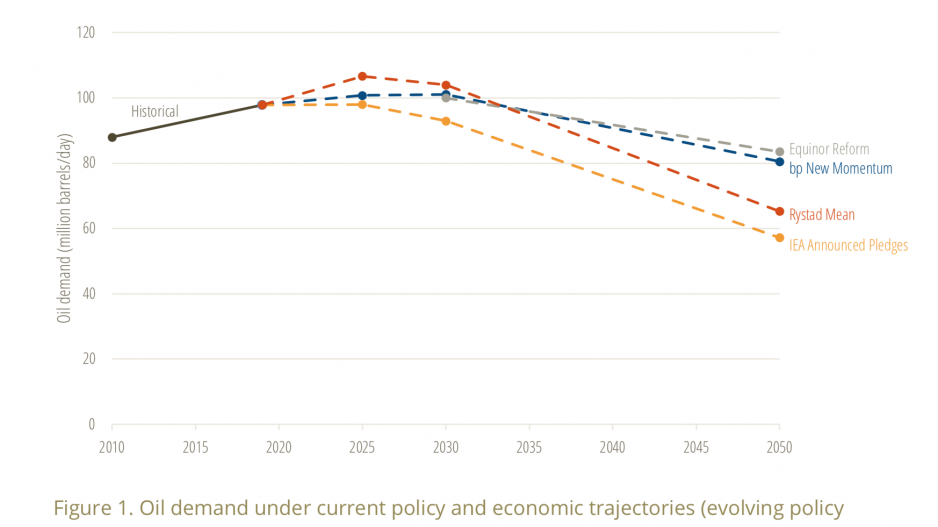

The report forecasts a long-term decline in oil demand before 2030 at the latest according to Pembina’s most industry friendly model where no new climate policies or regulations are adopted beyond what already exists. In models where countries successfully reach their Paris Climate Accords’ goal of net-zero emissions by 2050 demand is projected to fall nearly in half, 54% to 84% from 2019 levels.

Since many signatories to the climate accords are far behind their stated goals, in the model that assumes the scale and pace of environmental change is the same as it has been in recent years the projected decline is between 17% and 51%.

The report highlights three major reasons for this decline: The continued accelerated demand for electric vehicles, growing concerns for climate change and the accompanying regulation and uncertainty for future oil demand from downstream industries like plastics manufacturing.