British Columbians hoping for a residential real estate market that differs from 2022 will be disappointed, according to a new regional forecast.

Sales and prices this year are projected to remain relatively similar to what was seen last year, according to the Real Estate Board of Greater Vancouver’s (REBGV) Residential Market Forecast.

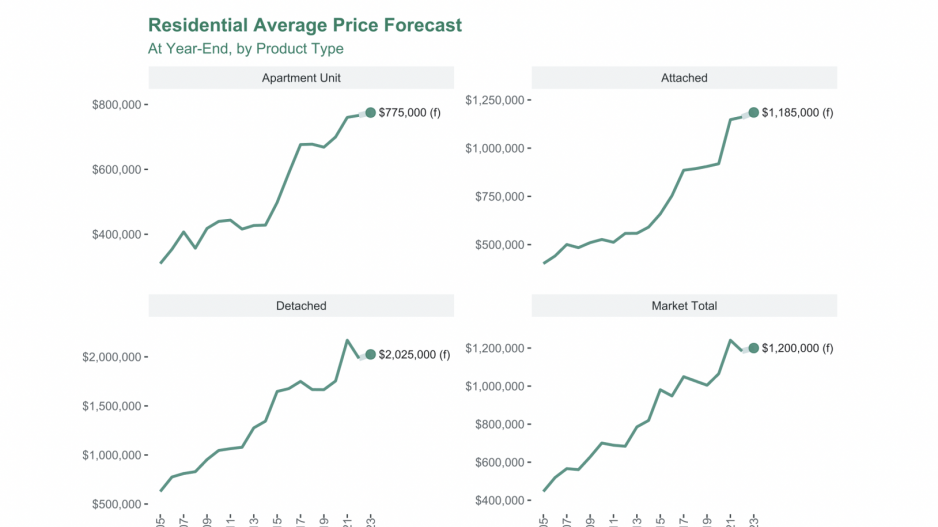

The prediction that will “raise the most eyebrows” is a slight price escalation across all property types, to an average home price of $1.2 million in 2023 – a 1.4 per cent increase over 2022, said Andrew Lis, director of economics and data analytics with REBGV.

Lis said the expected change is more of a “flat projection” than an increase.

“Our market data is still showing very low inventory. There's just not a lot of product available at the end of the month for sale,” he said. “There's this contrasting dynamic where you have a continued decline in inventory, but [the region] continues to increase in population and at the end of the day, that's what we see is putting a floor under prices.”

To show the stark difference in supply now versus what has been seen historically, Lis said that in the early 1990s, the region would tend to see around 18,000 units for sale at the end of a month. Today, the trend is around 8,000 units for sale, despite population growth and ongoing demand for housing.

Residential sales across Metro Vancouver, for all housing types, are expected to land at roughly 28,500 in 2023, a 2.6 per cent decrease compared to the 29,261 sales in 2022, according to the REBGV forecast.

Rapid interest rate hikes that have led to higher mortgage payments are “keeping a lid on sales,” said Lis, noting low buying and sales activity.

“That's what's informing the forecast, because the Bank of Canada has signalled that they're going to pause hiking rates any further, unless there's any kind of economic data that suggests they need to go further. Assuming that they do pause, or don't move up too much more from where they are, it's quite probable that the market activity overall looks a lot like it did in 2022,” he said.

Another factor that may impact the market are the immigration targets set by the federal government between 2023 and 2025. Lis predicts that this will fuel some activity on the purchasing side of the residential market, as well as demand for rentals.

Risks to REBGV’s forecast include the risk of a recession, and of economic stagnation and higher mortgage rates, according to the report.