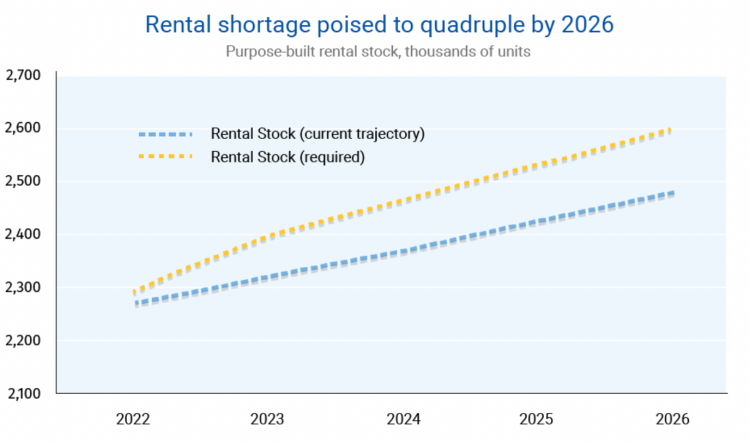

Demand for rental units in Metro Vancouver and the rest of Canada could quadruple by 2026, further highlighting how demand is outpacing growth, according to an RBC special report.

While the report looks at nationwide demand, Robert Hogue, assistant chief economist at RBC, said that the general direction of demand is “potentially the same” for B.C.

“There's still tremendous demand that we expect over the coming years for rental units,” said Hogue. “Even though we have seen over the last year some increases in the construction of purpose-built rental apartments, it’s unlikely to be enough.”

Nationwide, the purpose-built rental housing stock increased by its fastest pace since 2014, according to the RBC report. But absorption rates in B.C. and across Canada outpaced the construction, resulting in low vacancy rates, said Hogue. Increases in immigration and pressures on construction further compound the issue.

This is mirrored by the Canada Mortgage and Housing Corp. (CMHC) January market rental report, which states that demand is outpacing growth in Canada’s three largest rental markets, which includes Vancouver.

“The shortages that we have right now are likely to grow quite substantially in the coming years. Unless we're ready to ramp up the pace of construction,” Hogue said.

Across Canada, this could result in a shortage of 120,000 rental units by 2026, the report said. In order to achieve rental stability, the nation will have to add 332,000 units to its current rental stock.

In Vancouver specifically, the purpose-built rental stock increased by 2.8 per cent, in 2022, according to RBC. Across the Vancouver census metropolitan area, which accounts for all of Metro Vancouver, there was an increase in rental stock of 3.3 per cent, according to CMHC. In all of B.C., 14,546 purpose-built rental homes were registered in 2022, according to the B.C. government.

However, fast absorption of those units resulted in a vacancy rate of 0.9 per cent in Metro Vancouver, according to CMHC. For condominium rentals, the vacancy rate is 2.2 per cent.

Population growth and immigration are main drivers of this demand, with new data from Statistics Canada giving “further confirmation,” Hogue said.

As of Jan. 1, 2023, Canada’s population reached an estimated 39,566,248 people, according to StatCan. This represents a growth of 1,050,110 people from Jan. 1, 2022, to Jan. 1, 2023.

“The magnitude of the increase in population we saw in 2022, could possibly not be sustained. What I think is reasonable to expect in the coming years is still very solid population growth in Canada, fuelled by immigration,” Hogue said.

In 2022, Canada recorded 437,180 immigrants and an estimated net-increase of 607,782 non-permanent residents, according to Statistics Canada. Both numbers “represent the highest levels on record,” said the agency in the data release.

Hogue also highlighted that labour and inflationary pressures on construction are both “big issues.”

“Talk to any builder and developer, they will tell you pretty clearly that there's a significant constraint on more units being constructed,” he said.