A receiver is being appointed after two companies involved in the delayed development of a ski and snowboard resort near Squamish defaulted on loans.

B.C. Supreme Court Justice Paul Walker heard the petition from Aquilini Development LP (ADLP), Garibaldi Resort Management Co. Ltd. (GRMC),and 1413994 B.C. Ltd. on Monday in Vancouver.

They applied for the appointment of Ernst & Young to manage Garibaldi at Squamish LP (GAS LP) and Garibaldi at Squamish Inc. (GAS Inc.).

Walker said he was “satisfied the order should go” and set Jan. 15 as the next court date.

The petition was filed Sept. 22, almost two months after the lawyers for the petitioners demanded immediate payment of the $65 million owing as of May 31, including interest and legal costs.

“GAS has failed or neglected to pay the amount demanded (or any part thereof) to the petitioners,” said the petition.

GAS Inc. incorporated in late 2001 to develop the Garibaldi at Squamish resort on unceded Squamish Nation land on Brohm Ridge, 13 kilometres north of Squamish.

In 2007, GAS signed a memorandum of understanding with the Squamish Nation.

The project is a partnership between Vancouver’s Aquilini and Gaglardi families, whose private companies own the Vancouver Canucks (Aquilini Investment Group) and Dallas Stars (Northland Properties).

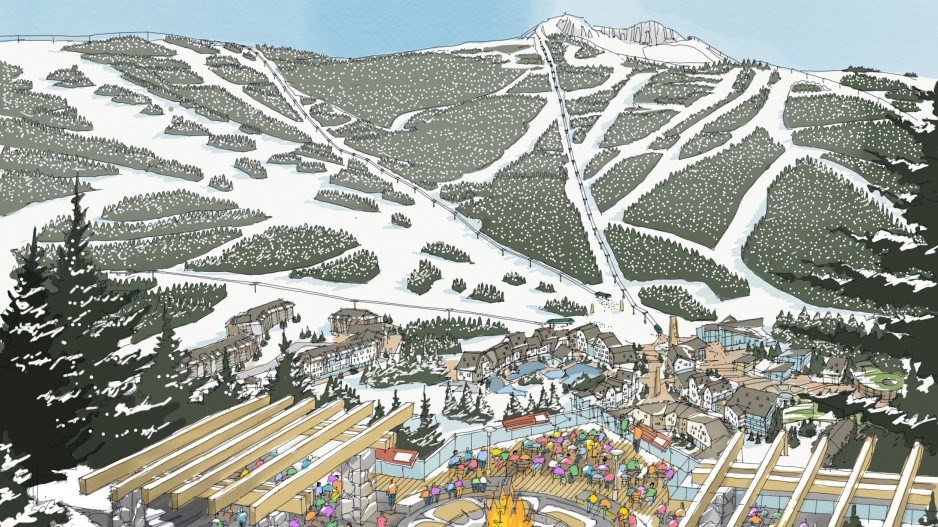

When the province granted an Environmental Assessment Certificate (EAC) in 2016, Garibaldi at Squamish was estimated to cost $3.5 billion.

The certificate was extended in 2021 with a Jan. 26, 2026 deadline to begin substantial construction. The 20-year project foresees building 5,000 residential, commercial and hotel units.

“However, no construction has been commenced and many of the conditions to the EAC remain outstanding,” the court petition said. “GAS and the project generate no income and are entirely dependent on third-party funding.”

Under an October 2018 agreement, GAS Inc. assigned and transferred all of its interest in the project to GAS LP.

In a credit agreement from January of that year, GAS Inc. issued debentures to lenders ADLP and GRMC for $2.28 million and $14.49 million, the amounts advanced by the respective entities, with a Dec. 31, 2021 maturity date.

But, in June 2022, funds advanced by Luigi Aquilini under the first debenture had been exhausted and GAS LP issued a second debenture to Aquilini with a Dec. 31, 2024, maturity.

“GAS LP failed to repay the principal sums under the 2021 debentures together with all accrued and unpaid interest then outstanding and the other obligations then outstanding, on the 2021 maturity date. This failure constitutes an event of default under the debentures and the [general security agreement],” the petition said.

Last May, Aquilini assigned all of his interest in the 2024 debentures to an affiliate of his: 1413994 BC Ltd.

Then on Aug. 3, lawyers for the petitioners demanded the immediate payment of $64.89 million.

“As of Sept. 21, 2023, there were no other security interests registered against the personal property of GAS. GAS owns no land,” the petition said.

Vicki Tickle, lawyer for the petitioners, told the court that GAS LP is now indebted to the petitioners for approximately $70 million, including interest.

“The nature of the project and the lack of consensus regarding its ongoing development, and the funding thereof, requires the appointment of a receiver,” Tickle said.

The 10-member GAS Inc. board includes one of Luigi Aquilini’s three sons, Roberto Aquilini, and senior Aquilini vice-presidents Jim Chu and Bill Aujla.

Chu is a former chief constable of the Vancouver Police Department and Aujla is a former general manager of real estate for Vancouver city hall.

From Northland Properties, the board also includes Northland chairman Robert Gaglardi, and corporate lawyers Stephen Jackson and Rob Toor.

The most-recent entry on Garibaldi at Squamish’s website is a fall 2023 newsletter that said the project team has been working on plans for the highway interchange and main access road up to the main village. Engineering firm WSP Global Inc. came up with an alternative route to “steer clear of the Brohm River completely,” the newsletter said.

The website also said the project aims for a fall 2028 opening.