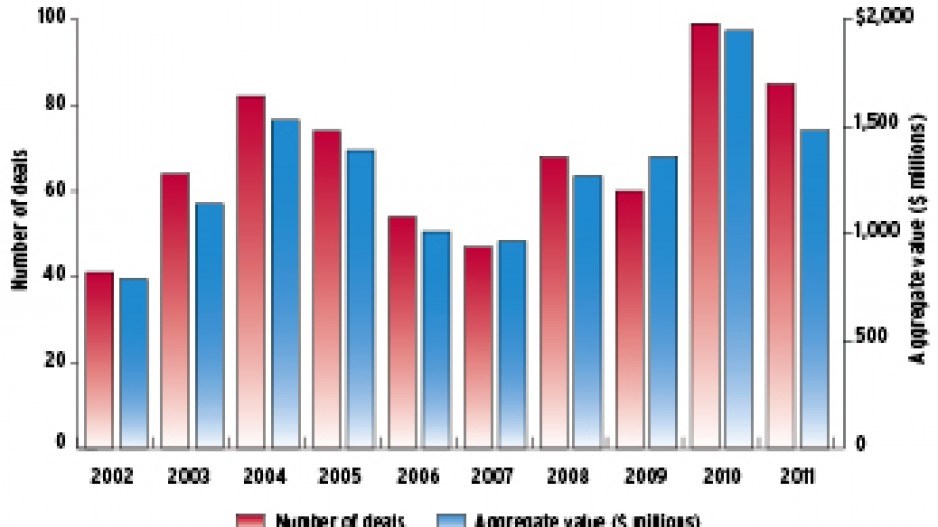

A “voracious appetite” for investment properties led B.C. to its second-best year on record for investment deals, according to Avison Young’s roundup of last year’s transactions valued in excess of $5 million.

The total of 85 deals with an aggregate value of approximately $1.5 billion was second only to the 99 deals totalling $1.9 billion recorded in 2010. The activity was also equal to that of the market in 2004 when 82 deals with an aggregate value in excess of $1.5 billion were done.

Retail properties, particularly in secondary markets, were key in 2011, accounting for 42% of assets by value. A lack of supply tilted the market in favour of retail properties, according to Avison Young principal Rob Greer, with private vendors lured to sell as cap rates compressed in the face of buyers’ appetites. Meanwhile, cap rates in the 6% to 7% range (versus 5% in Vancouver) lured investors to Merritt, Squamish, Williams Lake and other secondary markets.

Greer credited the listing of Thunderbird Village, a shopping complex off 200 Street in Langley that traded for $148 million in October, as the trigger for much of last fall’s activity.

“Then we started to see a couple of sales trickle in, and then some other vendors obviously thought, hey, this is probably a pretty good time,” he said.

Greer sees investors continuing to gravitate to secondary markets in 2012.

“I think you’re going to see more sales activity in Kelowna. There’s a lot of retail up there, and I think some owners are going to consider selling one or two assets this year. Vancouver Island’s another area where I wouldn’t be surprised if there’s a few other sales that happen, and the same thing with the Fraser Valley.”

Trust and hope

The outcome of last week’s public hearing regarding rezoning of Rize Alliance Properties Ltd.’s site at Kingsway and East Broadway in Vancouver won’t be known till after this column goes to press, but a few things were evident as the rezoning application was introduced and the first of approximately 190 people stepped forward to speak.

The project as proposed in the latest rezoning documents is less than what was originally proposed, both in height and scope. The original 32-storey tower proposal for the site is now down to 19 storeys, but is still not short enough for the several speakers who pointed out that the maximum height differs by a mere 30 feet from the original proposal. (The mixed-use project promises five-storey components, too.)

Moreover, rental housing on site was reduced from 40 to 15 units, and now, following a city staff suggestion in January, will be eliminated altogether (as will artist studios) in favour of a $6.25 million community amenity contribution. (Artist studios were envisioned, in part, to replace those lost in a fire on the site on December 24, 2009.) The cash will ostensibly go to support rental housing and studio space in the area, but as Councillor Heather Deal asked, what guarantees are there? Staff, in turn, put the onus on Deal and other councillors to spend the cash appropriately: “This is council’s decision as to where it’s allocated.”

But many speakers wanted firm guarantees. One pointed out that several other projects built in the neighbourhood in recent years have helped transform the community, but with few public amenities: “What did the rest of the community receive? A goal? A hope?”

Whatever the project’s final design is, affordable housing, pedestrian- and bike-friendly streets and good transit connections were high on speakers’ wish lists. This is a vision Rize Alliance principal Will Lin appears to share. Concluding his remarks to council, Lin stated: “Vancouver will continue to grow, and it’s a project like this that will accommodate this growth.”

With city staff noting “consistently high opposition” to Rize Alliance’s proposals for the site, Lin and architecture firm Acton Ostry will be challenged to define what shape “a project like this” ultimately takes.

Meanwhile …

PCI Group has signed T&T Supermarkets as a tenant in its Marine Gateway project at the south foot of Cambie Street. T&T joins Cineplex Odeon among the confirmed tenants at the project, which will also include office and residential space.

The project has attracted more than 8,000 registrants for its 415 residential units, which are scheduled to hit the market later this month. •