The 12 apartments above a sporting goods shop in Vancouver appear unremarkable, blending in with thousands of others in the beachfront Kitsilano neighbourhood.

But the building's bland, beige exterior hides a dark secret.

Authorities say the apartments are a key part of a money laundering operation run by Paul King Jin, an alleged member of a Chinese organized crime group, and a self-described loan shark.

Those details came to light through an ongoing civil forfeiture suit accusing Jin of laundering criminal money by having his niece buy the apartments with illicit funds, then taking out loans against them from a Hong Kong firm, which would be repaid in cash from illegal sources.

The Organized Crime and Corruption Reporting Project (OCCRP) has discovered that the money trail leads much deeper – into the murky underworld of organized crime in Asia.

Documents filed in B.C. Supreme Court by the province’s Civil Forfeiture Office name the Hong Kong company as Everwell Knight Limited, but they do not identify its owner.

OCCRP acquired corporate records showing that Everwell is owned by a Hong Kong property developer named Yu Shunhui, who has cultivated an image as a philanthropist and avid supporter of the Chinese Communist Party.

Behind Yu’s public persona, reporters found a web of underworld ties.

Yu owns a finance firm with three Macau-based brothers who controlled one of the gambling enclave’s major “junket” companies, which organize trips to casinos for high-rollers. Australian and Chinese authorities have cited the junket’s alleged involvement in money laundering in separate legal cases, but have not charged the brothers.

Curiously, Yu and two of the Macau-based brothers are included on a donors list for a charity that also received support from scores of accused organized crime figures.

But the Hong Kong property developer’s most obvious connection to alleged members of organized crime groups comes via the civil forfeiture suit, which accuses his company of laundering money for Jin.

Yu declined to comment for this article. Jin’s lawyer, Greg Delbigio, declined to comment on his client’s relationship with Yu via Everwell, or other accusations made in the civil forfeiture suit, because the case is ongoing.

Jin’s niece, who is accused of acting as a proxy property owner for him, did not respond to requests for comment sent to her lawyer. However, her legal response to the civil forfeiture suit calls the allegations against her “scandalous.” Her court filing says the properties were purchased with legitimate funds, and have not been used to launder money.

‘Dysfunctional legal system’

While Yu is relatively unknown outside Hong Kong and Macau, allegations about Jin have been splashed across Canadian media for years. Aside from the civil forfeiture case, Jin has been a suspect in two major police investigations into money laundering and organized crime.

Jin was charged in the first case, but it was withdrawn on a technicality. A prosecutor decided against filing charges in the second case, citing factors including the huge resources it would take to bring it to trial.

Jin’s activities were also scrutinized as part of the Cullen Commission, which was tasked by the provincial government to probe money laundering in B.C.

Jin was arrested in 2016 during the first investigation, dubbed E-Pirate, and questioned about alleged crimes, including extortion, running illegal gambling operations and money laundering. He denied the allegations, but told police he knew his activities put his life “in danger.”

“I'm a loan shark. I have money, you know,” he said, according to a police transcript that was filed as evidence in the Cullen Commision.

All charges stemming from E-Pirate were withdrawn when an informant was exposed in a document inadvertently handed to the defence after the police investigation was completed.

Calvin Chrustie, a retired senior officer with the RCMP who played a lead role in the investigation, blamed the mistake on disclosure laws that require defence lawyers to be provided with far more information than their counterparts in other countries.

“Out of 500,000 documents, or whatever they had, someone had accidentally put one piece of paper in the wrong pile. And that was the end of the case, which seems like a ludicrous outcome for a minor human error,” he said.

Christie, who now works with the security and intelligence advisory firm Critical Risk Team, said such lapses helped make Canada “a safe zone for the world’s most notorious crime groups.”

“Canada provides a dysfunctional legal system that fosters a low-risk environment,” he said.

After E-Pirate fell apart, Jin came into police sights again with another investigation called E-Nationalize. According to a statement by a special prosecutor appointed to evaluate the case, police recommended charges against Jin that included “participation in the activities of a criminal organization,” as well as instructing a “person to commit robbery with firearm for benefit of criminal organization.”

The evidence from E-Nationalize was handed to the British Columbia Prosecution Service in 2021. But after two years of consideration by the agency, special prosecutor Chris Considine announced in March that he would not press charges.

In his statement, Considine predicted “considerable dispute” over information gathered by police – including more than two million communications requiring translation from Chinese – which defence lawyers would claim access to under Canada’s broad disclosure laws.

Considine cited gaps in Canadian legislation that would make it hard to convict Jin – even though police presented evidence that he ran money through an underground bank called Silver International. Consodine said the use of such an underground bank could be prosecuted as a criminal offense in the U.S. and U.K., but not in Canada.

British Columbia’s attorney general, Niki Sharma, told OCCRP that the decision not to press charges was “frustrating.”

“For too long, international criminal organizations took advantage of B.C.’s open economy – laundering billions of dollars a year,” she said, adding that the government plans to strengthen civil forfeiture laws.

‘Proceeds of crime’

Authorities are now using civil forfeiture to go after some of Jin’s alleged assets – including the Vancouver apartments, and the money sent to Yu’s Hong Kong company, Everwell Knight.

The civil forfeiture case, filed in July 2022, alleges that Jin was “the beneficial or ‘true’ owner and directing mind of Everwell” and that he was using the company to launder money.

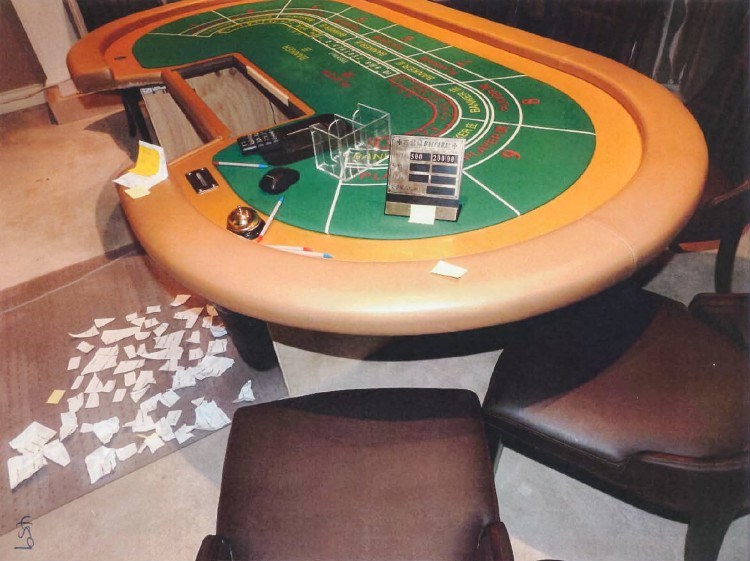

The suit also accuses him of laundering money through B.C. casinos, as well as the underground bank, Silver International.

That unlicensed financial network was allegedly run by a man named Jian Jun Zhu, who was killed in a 2020 shooting at a Japanese restaurant in Richmond. Media covering the attack reported that Jin was sitting next to him and survived, receiving a wound to the face from a piece of flying glass.

Silver International serviced clients including Asian, Middle Eastern and Mexican organized crime groups, according to a report Canada submitted to the Financial Action Task Force, a G7 anti-money laundering initiative, which was shared with journalists. The report said about $1 billion a year was laundered in the province through the underground bank and casinos.

The civil forfeiture suit reveals another method Jin allegedly used to clean illegal cash: With his niece acting as a proxy owner, police say Jin used illicit funds to purchase the 12 apartments above the store in Kitsilano, and one adjacent to it, as well as a property in West Vancouver. Together, they are worth about $12 million.

Jin took out phony loans against the properties in collusion with Yu’s company, Everwell, and used them “to launder the proceeds of crime” by using illicit funds to pay back the loans to the Hong Kong company, the civil forfeiture suit says.

But the legal documents leave many questions unanswered, including the role Yu played in the scheme.

Who is Yu?

Yu’s business activities are characterized by complex layers of corporate ownership. He has been involved in more than 40 companies in Hong Kong, Macau, mainland China and the British Virgin Islands, according to corporate records.

At the same time, he has cultivated a public image as a cultured Hong Kong businessman who supports the Chinese government.

In 2021, as Beijing dismantled freedom of speech in Hong Kong, Yu wrote in the state-controlled newspaper Wen Wei Po that he had “witnessed the great power of the leadership of the Communist Party of China.” Elsewhere, he has praised Chinese President Xi Jinping.

Yu has portrayed himself as a patriotic philanthropist, supporting COVID pandemic relief efforts, cultural groups, and poverty alleviation for the families of “martyrs” in Sichuan province who died in the Communist revolution.

Back in the late-2000s, before he became known for his charity work, Yu was named in a corruption case involving a high-level official.

At that time, Yu was chairman of a real estate development company in China’s southern Guangdong province, and he bribed a top provincial government figure, according to an official summary of a Chinese court case. The official was convicted, but there is no indication that Yu was charged.

That official, Chen Shaoji – reportedly known by the gangster epithet “Uncle Ji” – “illegally” provided Yu with an official government certification, and allowed him to use a “backup police car license plate” in return for two home theatre systems and a luxury Chopard watch, the court records allege.

Chen was handed a commuted death sentence in 2010 over the case.

Three years after Chen’s verdict, Yu resurfaced in Macau, the former Portuguese colony famous as China’s gambling capital, and as a hotbed of organized crime. This was when he began cultivating his image as an entrepreneur and philanthropist.

Among the organizations Yu has supported is the Macau branch of the Hong Kong-based Tong Sam Charity Association. The donor list is a who’s-who of alleged criminal figures, including Alvin Chau and Wong Tat Hou, who are both widely reported to be top members of the 14K triad organized crime group.

The Tong Sam Charity donor’s list also included two brothers from the Pang family, a gambling industry clan accused of having ties to organized crime.

Through a spokesperson, Yu declined to comment on his relationship to the Pangs, Jin and others mentioned in this story, or on allegations made against his Hong Kong company in the B.C. civil forfeiture suit.

“We are not accepting any questions or interviews at the moment,” Yu’s assistant said in a WhatsApp message.

The Pang Brothers

As it turns out, the Pang brothers – Pang Ngok Hei, Pang Ngok Wa and Pang Ngok Fong – are also in business with Yu.

The website of the Pangs’ Hong Kong-based conglomerate, Optimus International Group (HK) Limited, is peppered with business jargon like “honesty, innovation and win-win.” It also includes a list of Pang family firms in sectors like real estate, microcredit and jewelry.

One of the firms on the Optimus website, Zhongshan Lianfa Trading Co Ltd., is part-owned by Yu’s real estate company, Zhongshan Danan Group Co Ltd. There is little public information available about Zhongshan Lianfa, which was established to provide “financial support [through] small loans,” according to the website.

Pang Ngok Hei and his brothers also ran Meg-Star International Company Limited, a firm known as a “junket,” which facilitates trips to casinos – often in different countries – and commonly loans gamblers money. In 2022, Meg-Star was cited in a lawsuit by Australian authorities for alleged involvement in organized crime and money laundering.

A case brought by Australia’s financial regulator against Crown Melbourne Limited, a major casino operator, said “multiple individuals associated with [Pang Ngok Hei] and Meg-Star junket were likely to be involved in serious criminal activity, including a junket representative allegedly linked to human trafficking and sex slavery.”

In May this year, Crown agreed to pay a fine of 450 million Australian dollars (US$303 million) for violating anti-money laundering laws, including failing to "conduct appropriate ongoing customer due diligence."

The Australian regulator also noted in the suit that Pang Ngok Hei was a former executive at Suncity Group, Macau’s biggest junket. According to corporate records, Suncity was run by Chau, the alleged member of the 14K triad who donated to the Tong Sam Charity along with Yu.

Chau was recently handed an 18-year jail sentence in China on 289 separate criminal charges. The verdict against Chau repeatedly mentions the Pang brothers’ Meg-Star junket as a vehicle for laundering money.

Gambling junkets are notorious for cleaning illicit funds, and for working with organized crime, said anti-money laundering expert Eryn Schornick. Money launderers also tend to use a “diversified business portfolio,” including companies in sectors like real estate, finance and jewelry, she added.

A second brother, Pang Ngok Wa, is closely connected to another well-known triad figure.

Macau corporate records reveal that he was a co-owner of a “real estate and trading” company with Wong Wan-wa, also known as “Fat Girl,” who was jailed in 1999 along with her boss in the 14K triad, Wan Kuok-koi, or “Broken Tooth.” They started the company after she was released from prison in 2007.

Yu also owned companies with a man named Liu Shaowu, who has held roles as a director or co-owner in firms that include Wong Wan-wa and the Pangs, according to corporate registry documents. Among those firms is Zhonghshan Lianfa, the micro-loan company owned by Yu and the Pangs.

The corporate secretary for Optimus and Meg-Star did not reply to emailed requests for comment. A person who answered the phone at Meg-Star said the junket company was out of business, and that the Pangs would not reply to emailed questions, adding: “They don’t give interviews.”

Schornick said Yu’s alleged association with Jin, his business relationship with the Pangs, and the scores of firms he set up in different jurisdictions, raise questions about whether some of his companies may be used for money laundering.

“Who is behind Yu?” she said. “For what purposes is he creating this web of corporate structures?”

BIV and Glacier Media are proud to be the exclusive publishing partners of this Organized Crime and Corruption Reporting Project piece.