The size of B.C.’s biggest corporate finance deals has collapsed year over year, according to data collected on Business in Vancouver’s list of the province’s largest corporate finance deals in 2022.

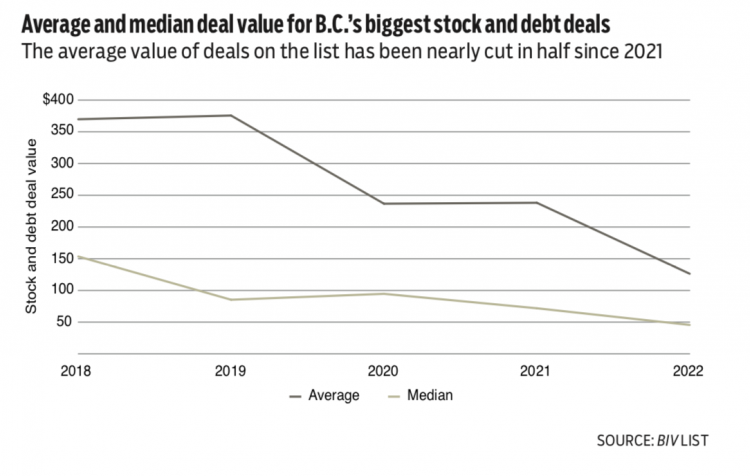

The average value of the biggest stock and debt deals sank 47 per cent from 2021 to 2022, while the average value of non-mining deals plummeted 61.9 per cent during the same period

Over the past five years, the average stock and debt deal value has fallen 65.9 per cent to $126.2 million in 2022 from $369.9 million in 2018. The median stock and debt deal value followed a similar trend, dropping 36.6 per cent to $45.6 million in 2022 from $71.9 million in 2020.

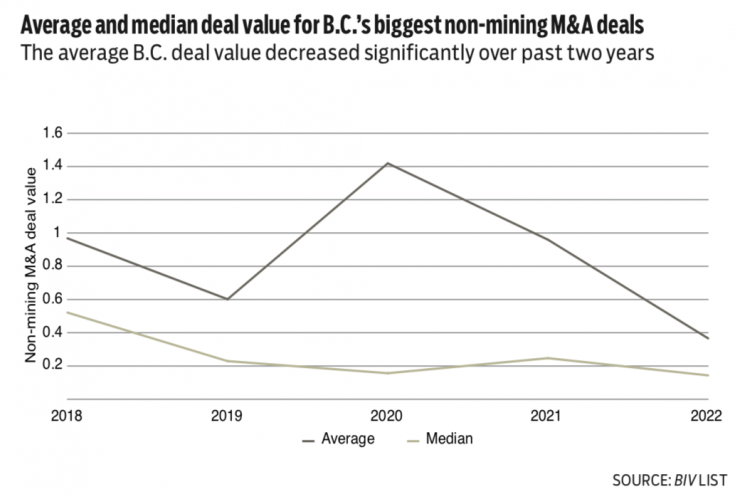

Over the past two years, the average value of non-mining M&A transactions that made BIV’s list plunged 74.2 per cent to $366 million since its last five-year peak of $1.4 billion in 2020. By contrast, the median value of non-mining M&A deals registered a 56-per-cent drop in 2019, and has since hovered around $200 million, give or take $50 million. This suggests that while larger M&A deals higher on the list have crashed in value, smaller deals lower on the list have not experienced similar declines. Andrew Kemper, a partner at Capital West Partners who specializes in mergers and acquisitions, said he has seen similar trends in his practice. During a BIV Business Excellence Series event March 29, Kemper noted that, overall, the M&A market has taken a downturn in terms of deal volume. But there is a caveat, he said, concerning medium-sized deals of between $50 million and $250 million.

“If you’re looking at the overall total M&A market in North America, no size criteria, Q3 and Q4 were down significantly – like off a cliff – from Q1 and Q2 last year. But that’s only if you included all the mega deals,” he said.