In January, Russ Taylor was in China watching the price of B.C. lumber crash to the floor in response to record declines in real estate prices.

“Every day we’d see lower prices, we’d see buyers in distress; it was just ugly,” the president of Vancouver-based International Wood Markets Group told Business in Vancouver.

“Builders had stopped building, they’d run out of cash, the banks weren’t lending money, they weren’t able to sell their homes because sales were down, and the whole supply chain just started to shut down with log [and lumber] inventories piling up at the docks.”

Taylor said he’d never seen lumber inventories that high, but the stockpile was to keep growing over the next four months.

“It got really bad in May,” he said.

As demand from China slows and in turn shakes resource-dependent economies like Canada and Australia, the question is whether the world’s second- largest economy is heading for a soft landing or an uncontrolled deceleration that could destabilize the global economy’s already fragile recovery from the 2008 financial crisis.

China is trying to steer its economy away from dependence on manufacturing and exports toward a more market-based, mature economy where services and consumer spending play a bigger part.

“When they started the rebalancing [of their economy] … everyone was cheering and saying this is exactly right,” said Yves Tiberghien, director of the University of British Columbia’s Institute of Asian Research. “But in practice this transition is very difficult, and it creates uncertainty and volatility.”

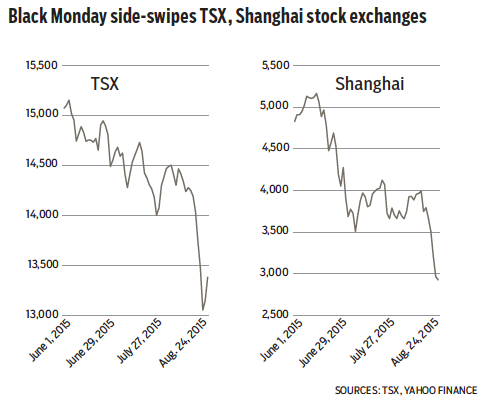

Investors have made their concerns about China’s economy clear in their reactions to the country’s surprise move to devalue its currency on August 11, followed by a stock market sell-off sparked by weak manufacturing data released August 21. The massive sell-off briefly spread to European and North American markets on August 24.

Tiberghien sees parallels between today’s stock market volatility in China and Japan’s stock market crash in the early 1990s. The difference, he said, is that Japan was a smaller economy that had already developed into a mature industrial economy.

“Japan was never this crucial,” Tiberghien said.

The upside of China being a country that’s still developing, he said, is that “there’s a lot of pent-up demand and pent-up consumption waiting to be unleashed.”

There are opportunities in China’s transition to a more market-oriented economy, but the lack of transparency in government and economic data means there is also a lot of risk, said Ari Shiff, president and founder of Inflection Management, a Vancouver investment management firm.

Shiff said his firm had been skeptical about demand numbers coming out of China for some time before the Organization of Petroleum Exporting Countries’ November 2014 supply decision that sent the price of oil tumbling.

“We thought oil was deeply at risk from Chinese demand and that at some point information would come out saying Chinese demand isn’t what you think it is,” he said.

“There was so much unknown that when you read what people were saying and you read the figures behind it and you kept digging and digging and digging, you could never get to original source material that would give you any comfort.

“It was a real emperor not wearing any clothes kind of situation.”

While economists and investors outside of China have questioned the accuracy of the information they’re getting, it’s also a big issue inside the country. Tiberghien said politics and public trust will continue to play a huge part in China’s economic performance.

Behind the scenes, there’s a political struggle between President Xi Jinping, who has pushed for market-based reforms, and exporters and the well-connected heads of state-owned enterprises who are fighting back.

“And then there’s a whole issue about the openness of information,” Tiberghien said.

“The Chinese public is much more savvy and connected than before, and they don’t trust the official information from the government.”

As China increasingly comes to depend on domestic consumption and the willingness of its citizens to invest their hard-earned money, earning public trust will be crucial.

“There is a tension here, and people are very skittish,” he said. •