After less than a week in his new role as Prime Minister, Justin Trudeau has been given some unpleasant news from the Parliamentary Budget Office regarding the outlook for the Canadian economy over the next several years.

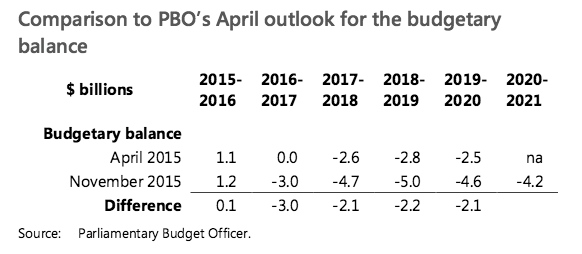

The economy will grow at a slower rate than predicted, according to the PBO’s report released November 10, with forecasts based on policy measures that were announced in April in the Conservative government’s Budget 2015. The PBO’s adjusted outlook does not take into account any measures or policy changes from the new Liberal government’s platform.

“The economic and fiscal outlook has deteriorated since the Parliamentary Budget Officer’s April 2015 report to the House of Commons Standing Committee on Finance,” the report states. “Although the Canadian economy is expected to rebound from the contraction in the first half of 2015, the recovery is expected to be restrained by weaker global activity and lower commodity prices.

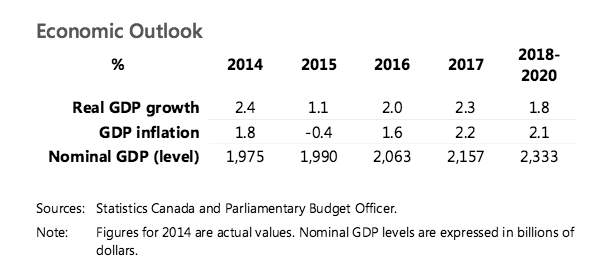

“Real gross domestic product (GDP) is expected to remain below its potential through 2019.”

Real GDP growth is expected to be 1.1% in 2015, downgraded from the 2.0% forecast in the previous budget, due to “weaker business investment and sluggish export performance.” Growth in 2016 is expected to be 2.0%, down from 2.1%. Between 2016 and 2020, nominal GDP will be lower than in the previous projections for each year.

Economic growth of 2.3% in 2017 is projected, which is in line with forecasts in a report released November 9 by the Organization for Economic Co-operation and Development (OECD).

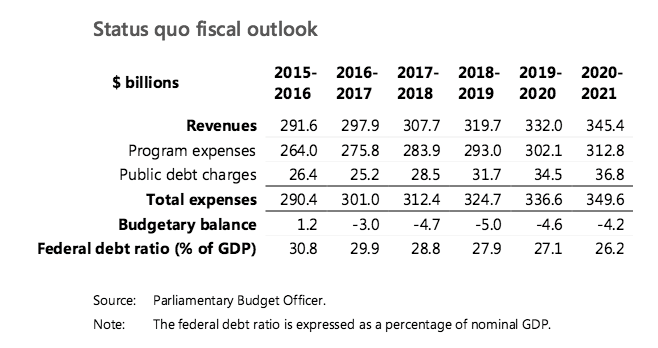

The new PBO outlook projects a budgetary surplus for fiscal 2015-16, as was the case in the April forecast. One of the primary drivers behind the surplus the surplus, the PBO said, was a one-time transaction.

“Surplus in 2015-16 was achieved partly from the sale of General Motors shares, which contributed $2.1 billion to other revenues,” the PBO said in its report.

“This will not be an ongoing source of revenue.”

Another factor contributing to a surplus in 2015-16 was an operating budget freeze that resulted in minimal growth in direct program expenses.

Given weak global activity, including in the United States, and low commodity prices, Canada is anticipated to run deficits for at least the next five years.

The U.S. economy has grown at a slower rate than anticipated through the first half of the year, reaching real GDP growth of 0.6% on an annualized basis.

“This setback was caused by temporary factors such as weather and port closures as well as weak non-residential investment in response to lower commodity prices,” the report said.

“In the second quarter, the [U.S] economy rebounded by 3.9%, but this was not sufficient to offset the first-quarter weakness.”

Worldwide, the OECD predicts global growth of 3.3% and 3.6% in 2016 and 2017, respectively.

“But a clear pick-up in activity requires a smooth rebalancing of activity in China and more robust investment in advanced economies,” the OECD said in a press release.

Some other factors behind the PBO’s downgraded outlook forecasts are a 20% reduction in EI premium rates in 2017 and a 3% annual increase in direct program expenses. As well, spending on benefits for elderly Canadians are expected to grow at a rate that is higher than GDP growth.

The latest forecast has decreased the projection for the price of West Texas Intermediate oil over the next five years. By 2020, the price is forecast to US$59 per barrel. This is almost 11% lower than the US$66 per barrel included in April’s forecast.