Despite continued stock market turmoil and the overall drop in executive pay, the top dogs at B.C.'s public companies added handsomely to their personal wealth in the first half of the year.

Based on Business in Vancouver's compilation of trades made by B.C. corporate executives and directors, 80 senior officers and directors earned more than $63.2 million from share trades in their own companies made between January and June 2012.

The largest trading gains so far this year include the $6.3 million earned by B2Gold Corp. (TSX:BTO) chairman Robert Cross from the sale of two million B2Gold shares at per-share prices ranging between $3.11 and $3.30 on May 28 and May 31.

The trades came two weeks after the company posted strong first-quarter results that included higher gold production than forecast and lower cash costs than budgeted for the period. The company reported production of 34,602 ounces of gold in its first quarter ending March 31, 2012, which was above the 32,461 ounces it had originally forecast. Per-ounce gold production cash costs fell to $587, well below the budgeted $669.

Half-a-dozen other executives and directors at B2Gold made large trades on May 28, collectively earning $11.2 million primarily from selling a small portion of their share holdings in the company.

The fact that executives have cashed in on some of the B2Gold's positive prospects hasn't eroded the company's value.

While its shares have been volatile over the past month, B2Gold's market capitalization has hovered around $1.24 billion in the last week. The company has also continued to post positive news. It reported a 6.3% increase in gold production to 36,803 ounces in its second quarter, which ended on June 30.

Other companies with insiders profiting from seemingly positive prospects include Vancouver-based TAG Oil Ltd. (TSX:TAO), which focuses on oil and gas exploration and production in New Zealand.

Company founder and director Alex Guidi sold 526,400 company shares over five days in the first four months of the year. The sale, among the largest of TAG Oil stock thus far in 2012, netted him $5.1 million. The trades add to the $3.3 million he earned from the sale of 550,000 shares last October.

Company director Ronald Bertuzzi also reaped more than $1 million from eight separate trades between January and April when he sold 125,000 shares at between $8.21 and $10.87 per share.

Overall, four of TAG Oil's insiders have netted $7.2 million thus far this year from share trades and exercising options as the company's results improved. For the year ending March 31, 2012, the company reported a tripling of oil and natural gas production and sales volume. That has resulted in a net profit of $12.4 million compared with a net loss of $1 million in 2011.

Some cash out, others cash in

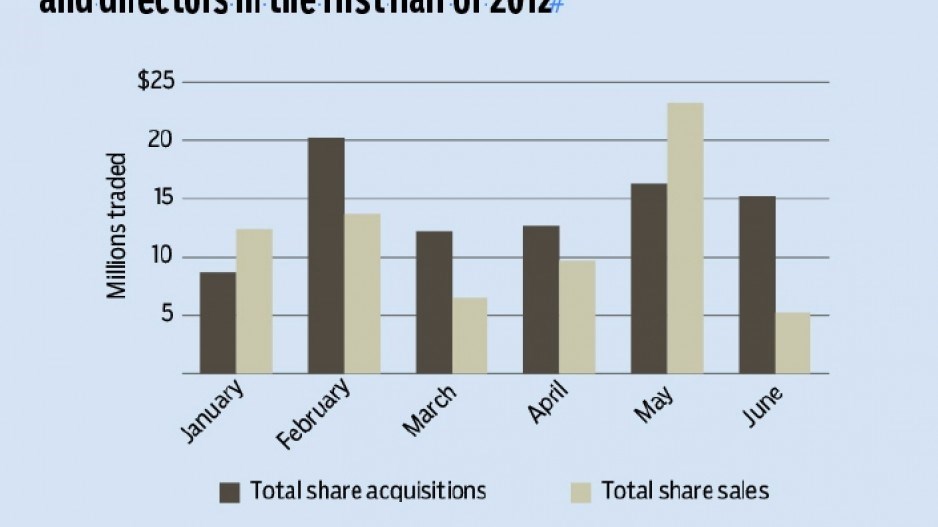

Compared with 2011's last six months, more corporate insiders in B.C. invested in their companies in the first half of the year than cashed out. (See "B.C. Corporate insiders cash out amid extreme market volatility" – BIV issue 1162; January 31-February 6.)

While some insiders continue to follow the "Sell in May and go away" investment adage, insiders overall kept buying up company stock throughout the summer. While there were 38 insider share sales worth more than $100,000 per trade in May and June, there were also 48 insider share purchases during the same period.

The largest trades in recent months were Jim Pattison's purchases of Canfor (TSX:CFP) shares, as well as Ross Beaty's acquisition of Pan American Silver shares (see table below). Other big buys included Peter Bull's $1.5 million purchase of Hardwoods Distribution Inc. (TSX:HWD) shares and Martyn Konig's $1 million prospectus investment in Euromax Resources Ltd (TSX-V:EOX), which added 6.67 million shares to his portfolio.

All told, while the equity markets have remained volatile so far this year, B.C.'s corporate executives continue to rake in the cash, with many adding to their net wealth in the face of an uncertain economic future.