West Vancouver penny stock promoter Anthony Jackson, under investigation by the B.C. Securities Commission, is seeking further restitution from a business partner who is spearheading an internal investigation of a company the two co-direct.

Jackson’s BridgeMark Financial Ltd. filed a claim in B.C. Supreme Court April 30 against Eyecarrot Innovations Corp. for $117,075 in alleged unpaid salary for work Jackson provided, through BridgeMark, as the company’s CFO since March 2017.

Eyecarrot has not yet filed a response to the claim. Jackson had also recently filed a $100,000 claim against Eyecarrot’s president and CEO Adam Cegielski for an alleged unpaid personal loan.

Cegielski and Jackson are both directors of Montego Resources Inc., a mining exploration and development company trading on the Canadian Securities Exchange for pennies per share.

The two have sparred publicly and in court over the past few months.

Image: Randy Pearsall/Business in Vancouver

On March 1 Cegielski issued a statement that Montego’s four-person board had fired Jackson as CFO and started to investigate the company’s financial transactions as they may relate to a BCSC investigation of an alleged illegal share distributions scheme — to which Jackson is a BCSC hearing respondent.

On March 7 Jackson, a certified public accountant, took Montego to court seeking a court-ordered AGM. The court subsequently sided with Montego, ordering a July 23 AGM so that the company could complete its internal investigation. Cegielski claimed Jackson refused to turn over the company’s online banking records.

Shareholders were then privy to an unusual back and forth set of press releases. On April 18 Jackson reported that Montego had terminated Cegielski as CEO, claiming Cegielski and two other appointed directors (who appear to back Cegielski) were invalid board members. Jackson also appointed himself CEO. On April 25 Cegielski shot back with his own release, calling Jackson’s release “baseless.”

Between the releases, the CSE halted trading of Montego.

Jackson has noted in court filings he is the only director of the four who was voted as such by shareholders, although it’s not made clear of what consequence this is. Cegielski has noted in court filings that Montego’s corporate rules allow for directors to be appointed. It’s understood the AGM will see shareholders vote for a new board.

Representing Montego has been Andrew McCoomb of Rose Fulbright Canada LLP, while Patrick Sullivan of Taylor Veinotte Sullivan is representing Jackson.

Cegielski’s concerns centre on a large investigation by the province’s securities regulator.

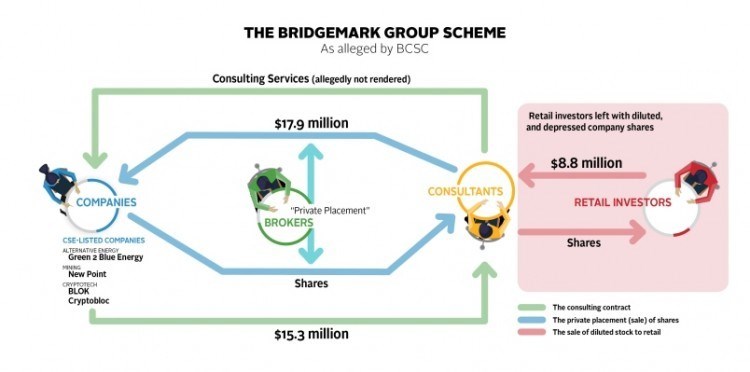

BCSC investigators have dubbed 25 consultants and their respective firms the “Bridgemark Group,” considering the close ties to Jackson and Bridgemark Financial Corp.

Since December 2018 the BCSC has maintained limited and temporary trade orders (bans) on most hearing respondents out of concern there may have been widespread illegal distribution of shares by 11 CSE-listed companies named as respondents — Montego not being one of them.

The companies, three of which were directed by Jackson, issued shares to the consultants, who simultaneously took on consulting contracts only to not perform any work, allegedly. The consultants then sold their shares to retail investors who were left with devalued and diluted (or generally worthless) stock.

Not unlike a number of companies Jackson has been in control of, Montego corporate filings show a similar pattern of transactions and activity as the 11 named CSE-listed companies presently being investigated by the BCSC.

Despite relatively little investment in its exploration sector, Jackson oversaw the raising of over $6.2 million from private placements (sale of newly issued shares) in November 2017, according to CSE filings.

Cegielski filed a response to Jackson’s claim, stating, based on the financial records he is in possession of, “there appears to be a large number of financial transactions entered into between Montego and a number of members of the BridgeMark Group named in the proceedings.”

Among them are BridgeMark Finanacial ($100,050); Jackson ($65,307); Justin Liu ($773,535); Tollstam and Company ($157,500); Lukor Capital ($92,542); Altitude Marketing ($341,250); Cameron Paddock ($2,887) Paddock Enterprises ($38,325); Essos Corporate Services ($228,952); Detona Capital ($7,000); Tavistock Capital Corp. ($175,000); JCN Capital Corp. ($150,000); John Bevilacqua ($60,962); Tara Haddad ($6,500); Danilen Villaneuva ($57,931); and Northwest Marketing Management ($260,000).

Montego’s most recent audited financial statement showed the company spent $1.79 million on consulting fees in 2018 and $1.14 million in 2017 (and no such expenses in 2016). Jackson became Montego’s CFO on Aug. 24, 2016, while former North Vancouver CAO Kenneth Tollstam became a director and CEO on Oct. 4, 2016, according to corporate records.

Cegielski claims there is an additional $2 million in unaccounted funds.

Cegielski “determined that the company has very little to show for the issuance of tens of millions of shares that took place while Mr. Jackson was CFO and the controlling mind behind Montego's affairs.

“Montego has determined that Mr. Jackson presided over the distribution of large amounts of money raised by the company through private placements to persons who are respondents in the BridgeMark proceedings,” Cegielski’s April 25 release noted.

However some of the aforementioned Bridgemark Group members who received payments from Montego do not show up on CSE records of share distributions in 2017.

For instance, Tollstam and Company did not purchase any shares. But the company’s principal is Kenneth Tollstam and his wife Anne Tollstam bought $32,000 worth of shares while his daughter Lisa Jackson, Anthony Jackson’s wife, bought $160,200 in shares.

Lisa Jackson and her father bought a $16 million waterfront home in November, records show.

Lisa Jackson, a realtor, is under investigation by the Alberta Securities Commission for a similar alleged illegal share distribution scheme involving Prize Mining Corp.

That notice from the ASC named “Prize Mining, Michael McPhie, Feisal Somji, David Schmidt, BridgeMark Financial Corp., Anthony Kevin Jackson, Justin Edgar Liu, Seungkap Kim, Kyung Kim Yoon, Lisa Jackson, Detona Capital Corp., Tryton Financial Corp. and Rockshore Advisors Ltd. (formerly Cam Paddock Enterprises)” as respondents. Trade orders similar to the Bridgemark Group have been applied to the Prize cohort.

Records show another of Montego’s investors (and consulting client, according to Cegielski) was 1084768 B.C. Ltd., which is directed by Lisa Jackson. In 2016, 1084768 reportedly owned shares in a company purchased by Prize. ASC respondent David Schmidt, who is also a hearing respondent to the BCSC, also owned shares in the company bought by Prize. Schmidt also purchased Montego shares in 2017 and is business partner to Von Rowell Torres (Sway Capital Corp.), who’s also a BCSC respondent and was fired as Montego’s corporate secretary by Cegielski on March 1.