Lower oil prices, while generally good for household budgets through lower gas prices, are a double-edged sword. The Canadian dollar’s tumble is adding to the cost of bringing products like California oranges north of the border

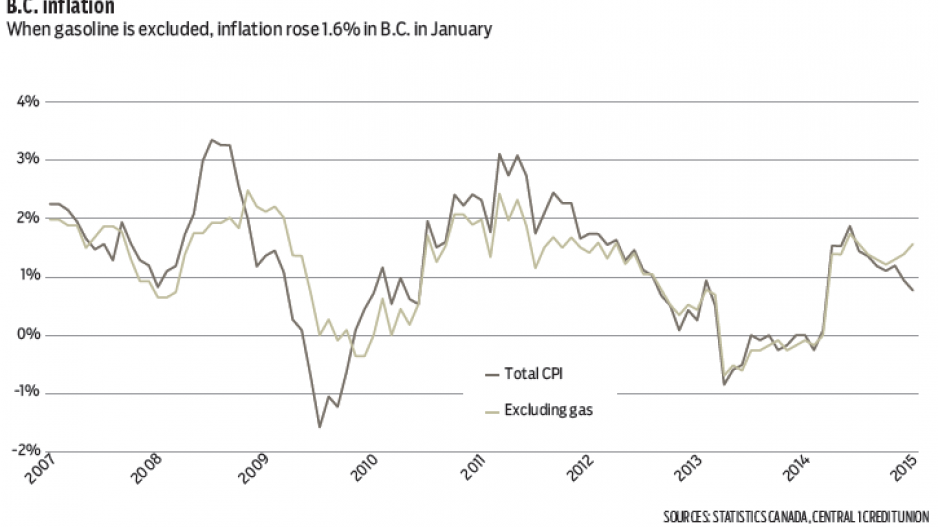

As expected, falling gasoline prices lowered B.C.’s consumer price inflation again in January, with year-over-year growth in the consumer price index (CPI) dropping to 0.8% from 0.9% in December, setting the slowest pace since March.

Although general consumer prices were still above a year ago, the seasonally adjusted CPI has declined since the summer months and points to some improvements in consumer purchasing power.

Gasoline prices were the key driver of lower inflationary pressure, with a 20% year-over-year decline. Although some seasonal factors were at play, the price at the pump fell 30% from the summer through January, which undoubtedly put a smile on the faces of motorists. A recent rebound in pump prices will reverse some of this decline in coming months. While lower gas prices have pulled CPI growth lower, consumer prices for other goods and services have pushed higher. Excluding gasoline, CPI growth climbed in January to 1.6%, and has shown signs of acceleration in recent months. In particular for those who need to eat, food prices were up nearly 4% year-over-year, led by meat (10.6%), fresh fruits (13.3%), and vegetables (9.7%). Other goods and services posting significant gains included tobacco products (12.1%) and electricity (8.8%). Clothing and footwear prices were up only 1.3% from a year ago, but jumped sharply from December.

Accelerating prices for food and other goods reflect higher import costs, which are also apparent when examining recent international trade data. Import price indices for food products, machinery and other goods have climbed significantly from a year ago. Lower oil prices, while generally good for household budgets through lower gas prices, are a double-edged sword. The Canadian dollar’s tumble is adding to the cost of bringing products like California oranges north of the border. Despite this upward pressure, we forecast total CPI inflation to remain mild at 0.6% this year and 1.2% in 2016 due to lower oil and gas price •

Bryan Yu is senior economist at Central 1 Credit Union.

.jpg;w=120;h=80;mode=crop)