U.S. tariffs could lead to a 6.8 per cent drop in output across Canada’s oil, gas and mining sectors over the next five years, a new report has found.

Released Wednesday, Deloitte Canada’s latest price forecast attempted to gauge the impact trade uncertainties would have on Canada’s energy, oil and gas sector.

Andrew Botterill, the lead author of the report and a Deloitte Canada expert on energy and chemicals, said the projected drop in output was calculated in a world where the U.S. puts a blanket 25 per cent tariff on all Canadian exports. He said the “dramatic” decline in oil, gas and mining would likely hit Canada’s economy hard.

“That would be very significant,” Botterill said.

The report from Canada's largest professional services firm comes as federal leaders spar over what role the oil and gas industry will play in Canada's economic future.

Last month, several CEOs of some of Canada’s largest oil, gas and pipeline companies released a five-point plan calling on federal political leaders to strengthen the country’s economy by declaring an “energy crisis” and using emergency powers to speed up development of key projects in the “national interest.”

The executives also called on Ottawa to eliminate the federal government’s cap on emissions; reassess the West Coast limit on oil tankers; and repeal the carbon levy on large industrial emitters.

Conservative Leader Pierre Poilievre said his party would commit to all five requests made by the oil and gas industry to expand their footprint in response to U.S. tariffs as a way “to get out from under America’s thumb.”

Liberal Leader Mark Carney said his plan to make Canada “the world’s leading energy superpower” includes working with provinces and territories to build a “historic nation-building” East-West electricity grid while also investing in conventional energy.

Canada’s oil and gas industry had strong year

Botterill said the tariffs have led the oil and gas industry to take a cautious approach to growth in 2025, but that it's coming after a stretch of strong growth.

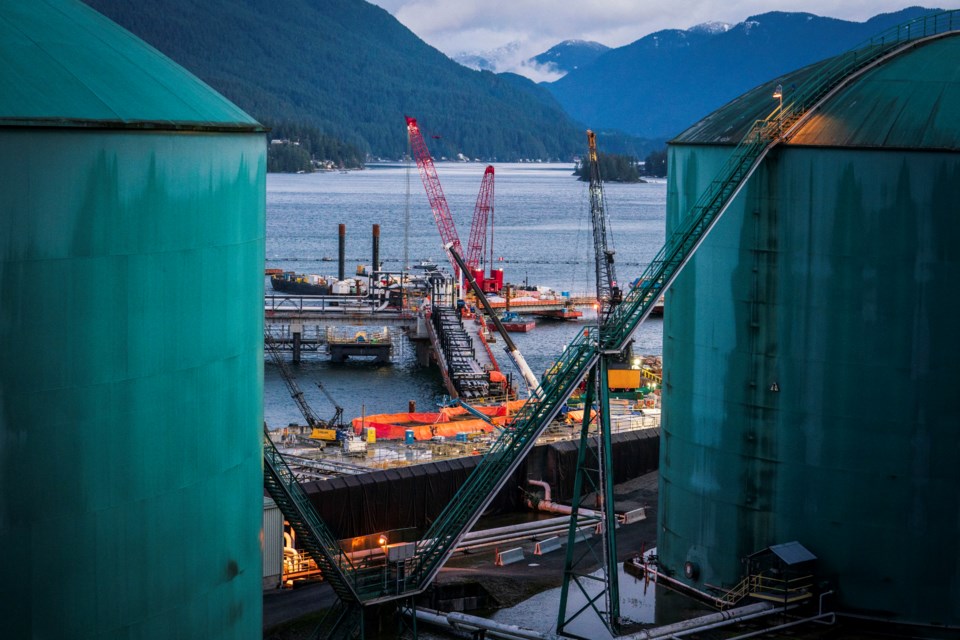

The report found recent demand for Canadian petroleum products has held strong in U.S. and overseas markets, with a record 12.5 million metric tons of crude exported from Vancouver in 2024.

That’s a 527 per cent increase from 2023, and was due largely to increased capacity brought online with the opening of the Trans Mountain expansion pipeline project, Deloitte’s analysts found.

In 2024, just over half of the crude exported from Vancouver went to the U.S. The other 49 per cent of oil went to Asia (primarily China but also South Korea). That’s up from four per cent in 2023.

“This shift reflects how the TMX expansion has already facilitated access to Indo-Pacific markets and demonstrates Canada’s capability to diversify exports away from the United States in the future…” the report states.

Short-term tariff impacts manageable, but long-term downturn risks ‘entire energy market’

According to Deloitte, the Canadian oil and gas industry has somewhat insulated itself by 'Canadianizing' its supply chains for steel, rigs and field equipment.

Canada’s weakening dollar and the lower price its crude oil fetches also both appear to be working in the sector’s favour. Deloitte’s analysis found the bulk of tariff costs will be passed along to refineries, and ultimately, U.S. consumers.

The upside to the tariffs, however, may only last so long. The report found the largest potential risk to Canada’s oil and gas industry comes from what the tariffs will do to the entire U.S. and Canadian economies.

In 2024, 85 per cent of Canada’s oil production was exported to the U.S.

Should an economic slowdown combine with increasing energy costs, demand for that oil could be stressed in a threat to the “entire energy market,” wrote the Deloitte analysts.

While the prolonged application of tariffs could lead to a 6.8 per cent output decline in Canadian oil, gas and mining, Botterill and his colleagues also found the U.S. would not be spared.

Between 2025 and 2030, a 25 per cent tariff on Canada would also rebound on the U.S, hitting it with a 1.9 per cent reduction in gross domestic product.

Botterill and his colleagues prepared their price and market forecasts through interviews with clients, and with information collected from government agencies, industry publications, oil refineries, natural gas marketers, and industry trends.

The forecasts also consider exchange rates and inflation trends.

B.C. in relatively better position to wait out tariffs, say analysts

Other economic analysts have recently forecast a wider downward swing across the Canadian economy as a result of the tariffs.

In March, experts with TD Economics predicted Canada’s economic growth would drop below previous trends in 2025 and 2026 before “finding greater balance” in 2027.

“Slowing population growth and the impact of tariffs on business and consumer sentiment are the drivers of lower growth,” they concluded.

TD Economics’s provincial economic forecast recently placed B.C. in a relatively stronger position to weather the impacts of tariffs.

The province’s economic expansion is expected to accelerate slightly in 2025 at a 1.7 per cent GDP growth rate. That’s below B.C.’s historical average but better than what many other provinces could face, including Quebec, which might see a 0.9 per cent GDP growth rate, according to TD.

The report said some of B.C.'s strengths include rising spending on food and beverages and a boost in tourism activity.

With 45 per cent of exports heading to non-U.S. destinations, B.C.’s trade relationships are also the second most diversified in the country after Newfoundland and Labrador, and almost double the national average.

“While not immune to tariffs, B.C.’s economy appears better positioned to absorb the impact of the trade war,” said the forecast.

The province’s lumber industry remains a weak point, as it could face devastating new tariffs on top of the current 15 per cent anti-dumping and countervailing duties, the TD Economics forecast said.