Supporters of B.C.'s liquefied natural gas industry tout the benefits of LNG as potentially driving down greenhouse gas emissions, especially in China, which has been aggressively switching from coal to natural gas for power.

While the growth in demand for LNG in China has been indeed impressive, it's not necessarily due to concerns about climate change, said Fatih Birol, executive director of the International Energy Agency (IEA).

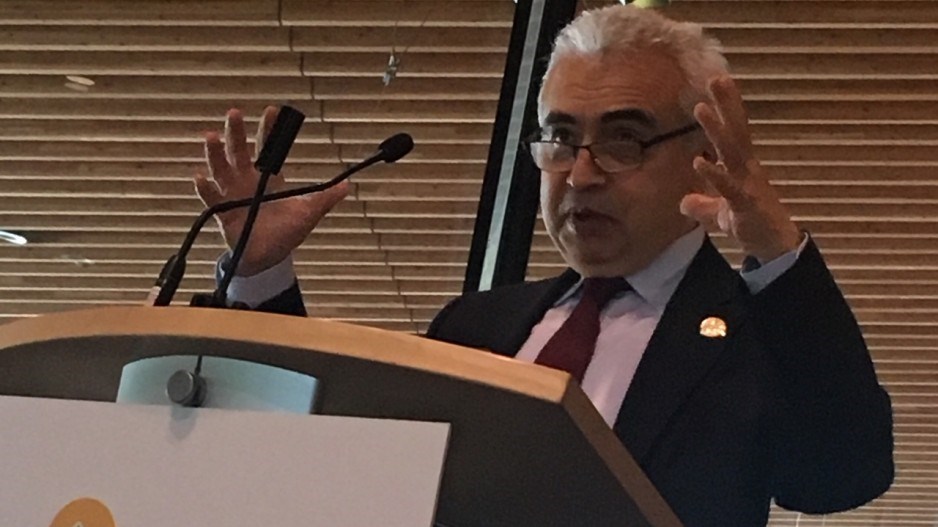

“The main driver here of China's very strong gas use is environmental issues, but not necessarily climate change – air pollution in the cities,” Birol told delegates at a discussion session on LNG in global energy transition May 28, during the second day of the three-day Clean Energy Ministerial (CEM) conference in Vancouver.

Referring to charts, Birol linked the growth in natural gas consumption in China with “significant improvement in air quality in several cities in China.”

He added India and Thailand are moving in a similar direction.

“Gas is considered to be a very important policy option to reduce the pollutants and improve the air quality,” Birol said.

Critics of B.C.'s LNG industry point to the switch to renewables, especially in China, as a sign that all fossil fuels, including LNG, is a dinosaur fuel source that has no future in a world that is transitioning to cleaner sources of energy. That's not how the IEA sees it.

Birol said that global energy demand grew by 2.3% in 2018 – the largest single-year increase in a decade.

“We see that almost half of the growth in the world energy came from natural gas,” he said, “followed by renewables, oil, coal, nuclear and others.”

“In other words, last year was a golden year for natural gas – huge growth – mainly driven by Asia.”

But other markets for LNG are developing quickly as well, as are suppliers. Europe, almost overnight, became a big new market for the growing American LNG industry.

The U.S. has been developing and approving new LNG plants at a rapid pace, compared to Canada, which has a single large LNG project under construction. Birol said two-thirds of the growth in LNG production and exporting is expected to be in the U.S.

“What's fascinating about this is these units, these facilities, began development years ago when the expectation and the economic model expected this product to go to Asia,” said Mark Menzes, the U.S. under secretary of Energy. “And yet over the past two quarters, the number one target of U.S. LNG has been to Europe. That's how quickly these global markets adjusted.

“Today, with the breakthrough in LNG production, we are exporting LNG to 35 countries on five continents,” Menzes said.

But Asia, especially China, represents the biggest growing market for natural gas and LNG, Birol said.

In 2000, 75% of the natural gas in the world moved by pipeline, and only 25% was transported in liquid form.

Now about 45% of the world's gas is transported as LNG, and the IEA projects it to be 51% by 2025. And whereas there were fewer than 10 LNG importing countries in 2000, by 2025 the IEA expects there will be 50.

He said the IEA projects strong growth in the LNG industry, “driven by economics, driven by environmental reasons.”

He cautioned, however, that although natural gas can reduce CO2 emissions when it displaces coal, the methane released in the extraction of natural gas has to be carefully managed and mitigated.

“We -- meaning gas industry, governments – need to take the necessary regulatory measure so that they are minimized so that there will be real benefits for the environment,” Birol said.