The B.C. government’s plan to eliminate Medical Services Plan (MSP) premiums on January 1, 2020, and introduce a new payroll tax has some restaurant owners concerned that the move will burden them with extra costs and keep them from having the extra cash necessary to attract workers with benefits packages.

Other entrepreneurs, whose payrolls are less than the minimum threshold of $500,000, will have an incentive to stay small and not grow their businesses.

That is because if their payrolls inch above that $500,000 threshold, they will have to pay a 2.92% payroll tax on each additional dollar of payroll.

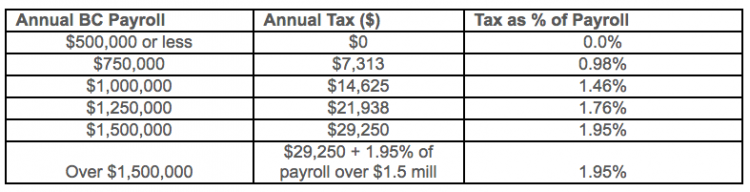

The new tax translates into a tax bill of $14,625 for a business that has a $1 million payroll and $29,250 for a business that has a $1.5 million payroll. Every dollar over the $1.5 million in payroll will be taxed at a lower 1.95% rate.

Those costs will be defrayed by the B.C. government’s elimination of MSP premiums (if the business owner has been contributing toward employee MSP premiums.)

But the changes mean that restaurant owners are unlikely to realize any additional cash flow to finance perks to keep workers.

(Table reveals that while the first $500,000 in payroll will be tax-free, each dollar in payroll between $500,000 and $1.5 million is taxed at a 2.92% tax rate. The tax then lowers to a 1.95% rate for each additional dollar of payroll)

The British Columbia Restaurant and Food Services Association recently commissioned a study to find ideas for how to battle the severe labour shortage in the industry, said CEO Ian Tostenson.

“One finding was that to attract workers into the hospitality sector, a benefit program is a good thing to have,” he told Business in Vancouver after the B.C. government’s released its 2018 budget on February 20.

“We thought that as MSP premiums were reduced, the employees and employers who were paying for the MSP would have money to pay for benefit packages and we thought that was great. The payroll tax could blunt that. If it is taking money from employers, it leaves employers with less money to provide a benefit program.”

Some restaurant owners, such as Umberto Menghi, who owns Vancouver’s Giardino Restaurant and Trattoria di Umberto in Whistler, have long paid into employee benefits plans.

Menghi contributes to MSP premiums as well as dental plans and RRSP-matching arrangements, he told BIV.

So while he likes the fact that he will soon not have to pay MSP premiums for workers, he fears that the new payroll tax will more than outstrip those savings.

“I’m leaving tomorrow with my accountant and my managing director so I will find out all the details,” he said February 20.

“I don’t plan to cut anything [out of employee benefit plans] but we’ll see what the increased cost is. We might have to put up the prices on the menu. We have stuck to the original menu prices when we opened. I haven’t changed it yet. Something has to give. You can’t cut yourself off, or what’s the point of being in business.”