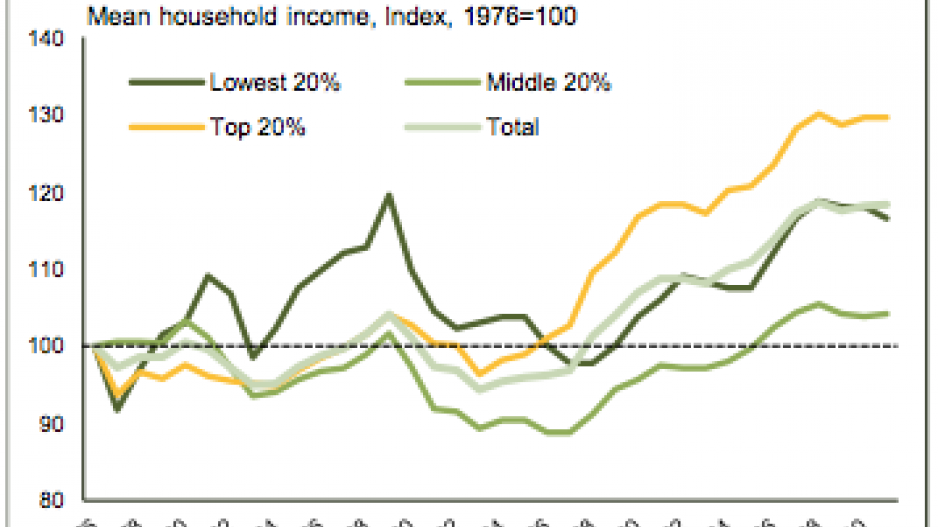

The data is in: the rich are getting richer in Canada, and their slice of the pie shows no sign of shrinking. Increasingly, economists are calling for action to even things up.

“We have data on income concentration [in Canada] over the last 30 years,” said Kevin Milligan, a professor of economics at the University of British Columbia. “What we see from that is that the farther you go up the income ladder, the top 1%, the top 10th of 1%, the top 100th of 1%, more and more growth in income tends to be happening.”

In a report published November 25 TD Bank economists Craig Alexander and Francis Fong warned that growing income inequality, which is part of a global trend, could pose serious threats to the Canadian economy in the future. Those consequences include stalled social mobility, with people unable to move up the income ladder, as well as less risk-taking and innovation.

Rising income inequality can also slow economic growth, which tends to lead to even greater inequality.

Canada lags behind other Organization for Economic Co-operation and Development countries when it comes to its tax system’s effectiveness at reducing before-tax income imbalances, Alexander and Fong said. While the federal government cut back social programs and transfers to provinces in the 1990s in order to pay down the large deficit of the time, governments have since tended to put policies in place that most benefited higher earners.

Increasing access to early childhood and university education, as well as other social programs, is another way inequality in Canada might be reduced, according to the TD Bank report.

While income inequality is growing in Canada, income concentration at the top is much worse in the United States, and that presents its own set of problems.

“America is willing to pay its high-skilled workers significant premiums, but at the expense of their low- and middle-skilled workers,” Alexander and Fong wrote. “Yet Canada must compete with these firms for talent.”

The rise of “super-managers” – highly paid executives and managers – is one of the main reasons income concentration has grown, Milligan said. Those high earners also tend to be adept at using the tax system to their advantage.

In a report published November 25 by the C.D. Howe Institute, Milligan calls for several changes in Canada’s tax system, including taxing stock options as income, getting rid of various tax credits and changing the way corporate income is taxed so that dividend and capital gains are taxed at a simpler, flat rate.

Milligan believes that increasing tax on top earners’ compensation and lowering tax on investment income will achieve tax fairness while at the same time encouraging investment.

“I’m concerned about growing inequality and increasing income concentration, but I know that not everyone shares that concern,” Milligan said.

“The goal here is for me to convince people who are even eat-what-you-kill capitalists that it’s important for them too.”

Canada’s tax system, which was last reviewed in the 1960s, is due for an overhaul, agreed Iglika Ivanova, an economist with the Canadian Centre for Policy Alternatives (CCPA).

But she believes that taxing investment income at a lower rate could make inequality worse. And there is scarce evidence that Canada’s economy is being harmed by a lack of investment, she said.

The CCPA also suggests raising corporate taxes, increasing tax rates for the highest earners and taxing all forms of income, including investment income, to reduce inequality.

Both Milligan and the CCPA recommend reducing “boutique” tax credits, such as the children’s fitness tax credit, because they tend to most benefit those with higher incomes.

The benefits associated with those credits could be achieved in other ways, Milligan said.

@jenstden