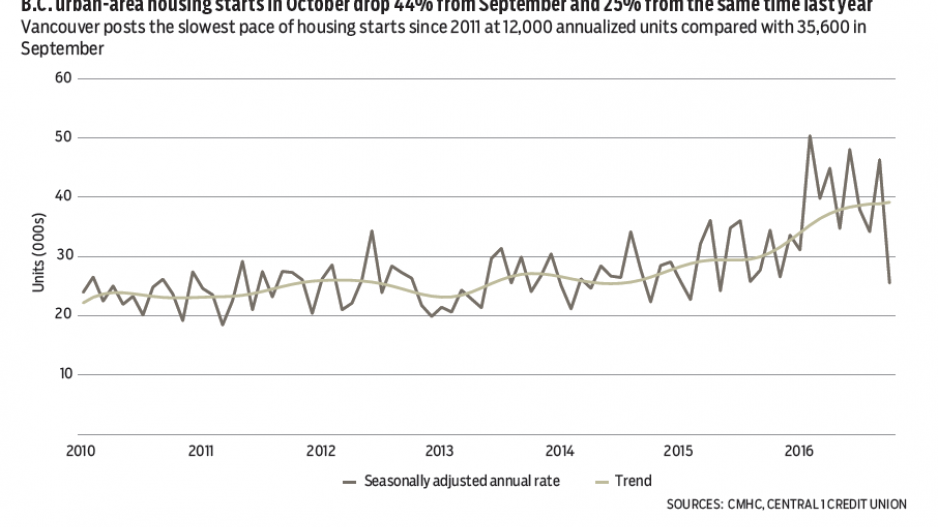

Following a strong September pace, B.C. housing starts plunged in October due to fewer apartment starts in Metro Vancouver. Provincial urban-area starts reached a seasonally adjusted annualized rate of 25,520 units compared with a pace of 46,300 in September, and 34,400 a year ago. This marked a month-to-month drop of 44% and a year-over-year decline of 25%.

Metro Vancouver posted the slowest pace of starts since 2011 at 12,000 annualized units compared with 35,600 in September and 25,000 a year ago. This was the sharpest one-month drop on record going back to 1990. In contrast, strength persisted among other urban areas.

While recent policy shifts, including the foreign-buyer tax in Metro Vancouver and tighter mortgage insurance rules, may seem like obvious causes, these are unlikely the main culprits. The foreign-buyer tax may have curbed detached spec building, but multi-family projects are planned and pre-sold well in advance. Recent policies would be unlikely to affect project timelines over such a short time frame. We anticipate a moderate rebound in November. As housing starts are highly volatile, especially in the multi-family-dominated regions, more months of data are needed to determine any shift.

Year-to-date housing starts in the Vancouver census metropolitan area were up 33% from a year ago.

Annual housing starts are forecast to climb 30% to about 41,000 units. Policy measures to cool the housing market will likely curtail construction growth and contribute to a 10% drop in starts in 2017.

Meanwhile, Statistics Canada further confirmed the strength of B.C.’s economy in 2015. B.C. gross domestic product growth was tops in the country at 3.3%, and was far stronger than the national expansion of 0.9%.

As expected, household demand was a key driver, with consumer spending growth of 3.1%, and residential investment spending up 9.1%. Growth in population and the strengthening labour market were key drivers of both, with the former fuelled in part by the strong housing market.

Net exports were a stronger-than-expected contributor to growth owing mostly to flat imports. Exports climbed 2.8%, driven by international goods demand, while slow growth held back interprovincial gains. A low Canadian dollar contributed to both uplift in international gains and curtailment of imports. Public-sector spending growth was also a surprise positive contributor to growth, with consumption up 2.8% after a 1.3% contraction in 2014. •

Bryan Yu is senior economist at Central 1 Credit Union.