British Columbia's commercial real estate market remained robust in 2011, despite a drop in the total value of the biggest real estate deals last year.

The top 100 biggest real estate deals last year totalled just over $2.3 billion, down from nearly $3 billion of deals in 2010.

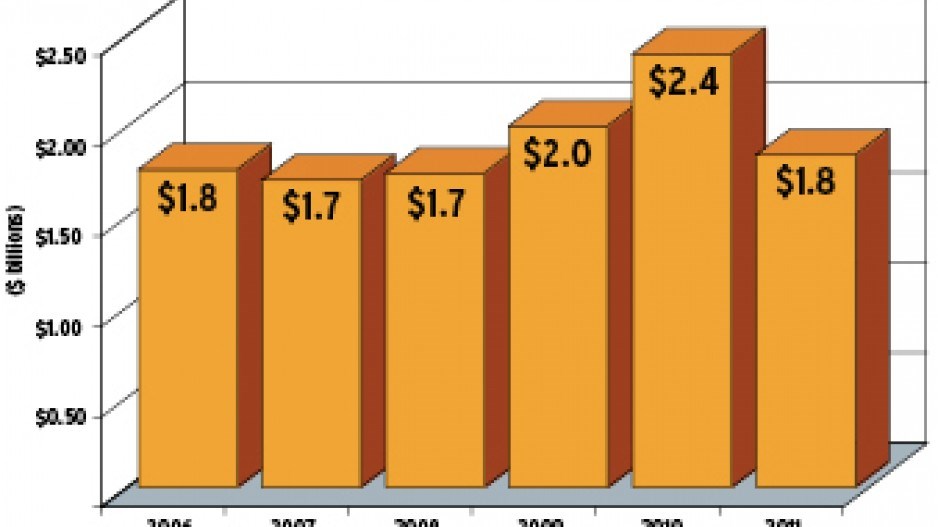

As in previous years, the bulk of the total value of the deals originated in the top 50 deals. Last year, those were worth a combined $1.8 billion in 2011. That was comparable to the total value of deals in B.C. prior to the global financial crisis, based on BIV's previous lists of biggest real estate deals.

The lack of prime commercial properties available for sale was one of the key reasons for the decline in total deal volume last year.

"It's still an excellent market, if you can find product," said Kirk Kuester, Vancouver brokerage managing director at Colliers International. "Real estate is perceived to be a safe place to be and for that reason, sellers are challenged in parting with real estate."

Bob Levine, principal at Avison Young, noted both private and institutional investors are increasingly looking to real estate as a relatively safe asset class in which to invest given the low returns in the fixed-income markets and high volatility in the stock markets.

"Your traditional buyers such as pension funds and life insurance companies seem to be putting a greater percentage of their assets into real estate than they have historically. It's driven by rates of return."

In 2010, many of the biggest deals involved institutional investors rebalancing their investment portfolios, which saw nearly a quarter of the top 100 real estate deals in 2010 consist of retail shopping centre trades. (See "Deals of the decade" – issue 1118; March 29-April 4, 2011.)

Mark Renzoni, executive vice-president of CBRE Limited, noted some of that portfolio rebalancing continued into 2011, but the region's stable real estate market has provided sellers a good exit opportunity. Such was the case for the Sutton Place Hotel in downtown Vancouver that was part of a hotel portfolio sale that included an Edmonton hotel for a total price of $197.5 million.

"The vendor saw there was a good amount of liquidity in the market; they felt comfortable that pricing was at a high level and it was time to pull those funds out of the assets," said Renzoni. "At the same time, you saw the purchaser, [Northland Properties], looking for core assets to enhance their portfolio mix and saw the Sutton Place as a jewel asset that comes around once every couple of decades."

The appetite for cash flow continued to bolster the multi-family investment market. The number of rental buildings in B.C. that made the top 100 list rose to 18 from 10 in 2010, with a total value of more than $291 million, up from $223 million in 2010.

Levine noted strong demand among private buyers has kept the market extremely liquid and competitive, especially with Metro Vancouver rental vacancy rates remaining low. "The deals tend to be smaller, but there are tons and tons of people that want to buy. It's very competitive. It's probably the most competitive [market] of them all."

While the global markets roiled over the solvency of peripheral countries in the Eurozone like Greece and uncertainty over economic growth, Renzoni said international buyers continued to be interested in Vancouver's market, which has contributed to strong real estate prices in the region.

"Outside pressure does help move values up, but it's not necessarily true that they're going to be the ultimate buyer. It may still be bought by a local or national player."

Property development cycle under way

But if you can't buy a building, many are deciding to build it.

The dearth of available commercial properties has led to a new wave of commercial and mixed-use property development that's likely to persist for years.

Levine suggested the number of new office towers could rise to six or seven, from the handful that have been announced so far that includes Telus Gardens, Oxford's 1021 West Hastings, Bentall Kennedy's 745 Thurlow Street and Credit Suisse AG's old stock exchange building development.

On the residential side, developers have also taken big steps to further transform the region with new neighbourhood developments. The number of land or development-related real estate sales on the top-100 list rose from 11 in 2010 to 20 last year, with the total value of sales rising to $517 million from $234 million.

Renzoni suggested that the low interest rate environment is a significant reason for the expected boost in development activity in the region. With low rates expected for at least the next couple of years, the window for development will remain open, further transforming the regional landscape.

"There's a lot of interest in development to add to the office inventory and office holdings of pension funds," he said. "With the office developments and the residential projects that are planned, we're probably going to see more cranes in our urban skyline since Expo 86."

Seller's market remains, for now

For all asset classes, it will remain a seller's market in the region. "Despite our best efforts, the owners today of downtown quality office inventory aren't interested in selling," Kuester noted. "They're interested in buying. There's tremendous demand, but we continued to be challenged by the continued lack of supply."

A CBRE forecast report suggested Vancouver's investment market will remain strong across all sectors. The total number of deals in the region is forecast to remain above 1,200 transactions.

But concerns still remain whether or not the current market is approaching its peak. Levine suggested that concern may result in more willing sellers in 2012 than in previous years.

"Prices aren't going down by any means, but I have a feeling that the supply this year may be higher than last year because there's certainly chatter among owners about how high prices can get," Kuester noted. "A number of owners who aren' married to their property forever are saying, 'If I'm going to sell, this is a good time to sell.' We're seeing signs of that."