Amica Mature Lifestyles’ $578 million sale to BayBridge Seniors Housing Inc. in December comes on the heels of other mega deals in the seniors’ housing sector, but the industry remains relatively fragmented and ripe for more consolidation.

Achieving that consolidation could be challenging, however, given that analysts have told Business in Vancouver that the sector has many more buyers than sellers.

Prices for the homes are also rising much faster than profits, making the investments increasingly expensive.

BayBridge, which is an Ontario Teachers’ Pension Plan subsidiary, paid $18.75 per share for Vancouver-based Amica – a 113% premium to the company’s $8.79 share price on the day before the deal was announced.

The transaction followed a mid-2015 pact under which Toronto’s Regal Lifestyle Communities (TSX:RLC) agreed to sell 23 seniors’ residences, including some in B.C., for $374 million to Ohio-based Health Care REIT (NYSE:HCN) and Ontario’s Revera. The deal valued Regal’s stock price at a 25.5% premium to its previous day’s closing price, further supporting the argument that prices are rising.

B.C. seniors’ residences were also in play last June when Sabra Health Care REIT Inc. (Nasdaq:SBRA) agreed to buy nine Canadian seniors’ housing facilities from an unnamed seller who was advised by Greystone Real Estate Advisors.

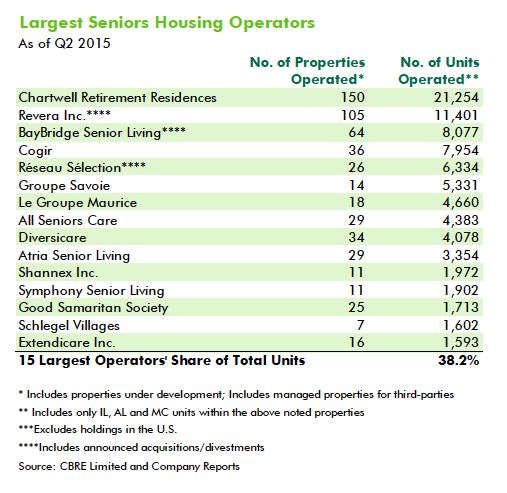

Despite consolidation, the 15 largest operators of Canadian seniors’ homes own a combined 38.2% of total units, said Steve Hiscox, who is senior director of seniors’ housing and health care at CBRE Ltd.

He then skimmed down the list and noted how most of those large operators are buyers, not sellers, which partly explains why increases in the values of companies is outpacing profit growth.

The best way to view how the price for seniors’ homes is rising, Hiscox said, is by looking at capitalization rates (“cap rates”).

A cap rate is the ratio of net operating income to a property’s value. So if a property is sold for $1 million and it generates $100,000 in net profit, the capitalization rate is 10%.

Hiscox said an influx of capital into the market, especially from U.S. sources, has compressed cap rates.

“It reflects that buyers had a price. For a long time, what sellers were offering was different. So there was a gap between the bid price and the asking price. Then, all of a sudden, there’s an influx of money.

"The big institutional players and the REITs [real estate investment trusts] want to spend their money. They can’t have it sitting in the bank, as that isn’t accretive. So they started to say, ‘If this is the price, then this is the price,’ and they started buying.”

The result, Hiscox said, is cap rates slumping from the 7.5% range into just over 6% for newer seniors’ housing properties in Vancouver and Toronto.

However, he added that, while the rate of return for investing in seniors’ housing has fallen, it remains significantly higher than the 4.5% average cap rate for investors who buy and rent high-end apartments.

Hiscox said seniors’ housing facilities tend to have higher cap rates because they are a higher risk than other classes of real estate.

“When you invest in an apartment building, you’re buying what is truly real estate backed by a business. Buying into a seniors’ home, you’re really investing in a business backed by real estate. Seniors’ housing is a lot like a hotel where there’s real estate but, at the same time, there’s housekeeping and care, there’s meal service. It’s a lot of things, so there’s more risk.” •