New home construction in B.C. remained strong in April with urban-area housing starts at a seasonally adjusted annualized rate of 44,600 units.

Following a similar March pace, builders have played catch-up after a weaker beginning to the year when starts tracked about 27,000 units led by a rebound in multi-family activity.

Weather-related factors may have played a factor in early-year sluggishness, but large swings in monthly figures are not unexpected. Healthy labour markets, population growth and low resale and new home inventories underpin high housing demand.

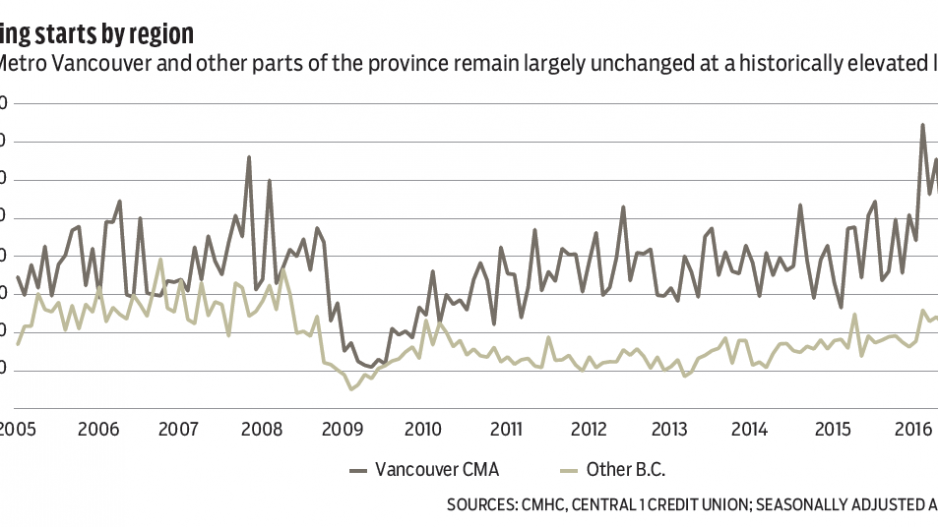

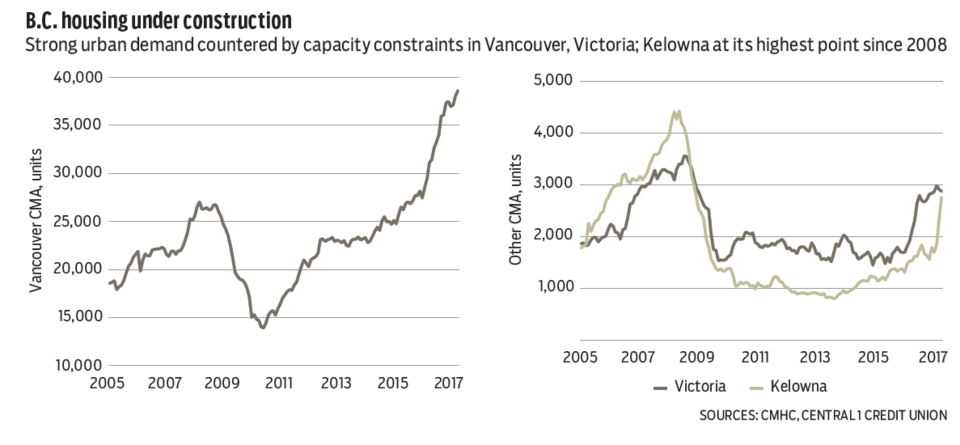

Starts in the Vancouver census metropolitan region (CMA) were unchanged from March at 30,400 units (seasonally adjusted), and climbed 25% in Victoria, but declined in Abbotsford-Mission and Kelowna.

Looking past monthly fluctuations, housing-starts trends in large urban areas continue to be elevated albeit down from the levels of a year ago in areas like Vancouver and Victoria. While demand remains strong, high numbers of units under construction in these regions have led to capacity constraints in the construction sector. Kelowna’s starts are at their highest level since 2007-08.

Year to date, provincial urban-area housing starts fell 13% through the first four months. The overall decline and shift from multi-family projects reflects a larger decline of starts in the Vancouver CMA over the same period.

Housing starts are expected to ease from current levels in coming months, holding annual sales in line with our 2017 forecast of 36,500 units (inclusive of rural areas), which would mark a 13% decline following a 33% gain last year.

In contrast, investment in non-residential building continued to disappoint. The dollar value of permits fell 3.8% from February to $247 million, contributing to a same-quarter decline of 11% from 2016. Permit volumes have trended lower since early 2016.

Despite a strong provincial economy, a subdued commodity sector continues to weigh on major project activity, while factors such a U.S. trade policy and retail competition, including online purchases, constrained commercial expansion. Same-quarter commercial permits fell 20% while industrial activity was flat. A 29% increase in government permits was not enough to offset private declines.

On the industrial front, higher investment in factories offset a drop in mining and agriculture-related structures. Commercial construction weakness has primarily reflected lower investment in office buildings. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.