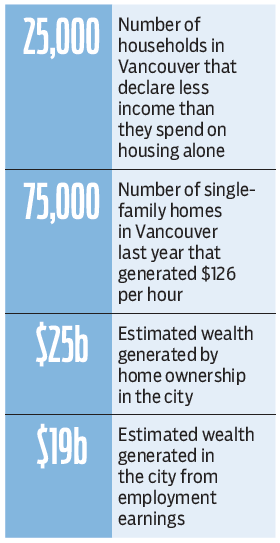

Top-paying jobs aren’t easy to come by in the city of Vancouver, which partly explains its spiralling unaffordability. But there are at least 75,000 tireless workers here who last year made the incredible average rate of $126 per hour.

Sadly, these workers are not among the city’s human inhabitants.

They are its single-family homes.

In fact, the quiet efforts of these houses (or, more accurately, the dirt on which they sit) were rewarded so handsomely last year that they made their owners about $25 billion, compared with an estimated $19 billion in citywide employment earnings.

That’s right: the owners of single-family houses in Vancouver made more by sitting on their assets than everyone in the entire city did by actually going to work.

That eye-popping calculation comes courtesy of mathematician Jens von Bergmann, a former teacher at the University of Notre Dame and the University of Calgary.

Von Bergmann now runs MountainMath Software in Vancouver, but his side interest is combining and presenting data in ways that help us better understand the city.

He is best known for his “census mapper” depictions of Vancouver, which vividly chart the distribution of everything from poverty and mortgages to Irish ancestry.

In bizarro Vancouver, 25,000 households declare less income than they spend on housing alone. Von Bergmann’s calculations – which are the result of combining data from the census and National Household Survey, the City of Vancouver, Metro Vancouver and BC Assessment – show just how much more lucrative it is to own a house in Vancouver than it is to, say, slog away in a cubicle or on the end of a shovel with the rest of the schmucks.

Von Bergmann, who first posted his findings on the MountainMath site earlier this year, also raises an interesting point about the Vancouver affordability debate: while there is a hue and cry about the origins of buyers’ money as it floods into the market, there is a lot less about how to treat that money once it has arrived in the bank accounts of sellers. “[There is] a tendency to view the money that is buying Vancouver real estate very critically, whereas once locals pocket the land-value rises, that same money is suddenly welcome and well deserved,” he said. “I find the vilification of the money pre-purchase in contrast to the silent acceptance of the money post-purchase problematic.”

So how does von Bergmann reach his conclusion that owners of single-family houses earned more than all Vancouverites did by working?

The latter part is pretty easy. The 2011 National Household Survey shows that the city’s average household income was $80,460 (for the 2010 tax year). Multiply this by the 264,575 households in the city for total income of $21.29 billion. But of this total, only 78% is attributable to employment or self-employment income (versus, say, investment income or welfare). So the total pre-tax amount that Vancouverites earned by actually working in 2010 was $16.6 billion.

Assuming that Vancouverites’ overall employment income rose at the rate Statistics Canada suggests median incomes did from 2010 to 2013, then did so again from 2013 to 2015, this results in total citywide pre-tax work income of about $19.2 billion.

Von Bergmann offers a slight caveat here: “Average incomes have probably risen a tiny bit more than median incomes [because of] the nature of incomes at the top … generally growing faster. But [the] effect will be very small.”

Calculating the amount “earned” by Vancouver’s single-family homes is trickier. First, von Bergmann had to identify these homes, which he did by combining a City of Vancouver property outline data set with Metro Vancouver land-use data to calculate all single-family and duplex properties, then subtracting stratified properties identified as having received multiple property tax bills.

In this way, he included houses with non-stratified basement suites or other dwellings, which are excluded from oft-cited census data that suggests about 47,000 single-family homes in Vancouver. Instead, von Bergmann concludes there are 78,740 single-family houses in Vancouver.

[It should be noted that the City of Vancouver has previously tallied about 76,000 single-family houses; von Bergmann said he could not explain that discrepancy. However, it’s not a big enough difference to alter his overall findings.]

Von Bergmann then looked at the increase in value of these 78,740 properties, according to data from BC Assessment. Excluding building-value increases, the land-value-only increases averaged $313,072, for a total land-value rise of $24.65 billion.

Von Bergmann acknowledges that there is a bit of wiggle room in his numbers, depending on how one defines a single-family home, and the availability of combinable data.

“But at the end of the day it does not matter much what definition to use,” he told me. “The fact that land-value increases outstrip [employment] income holds either way.”

By simply dividing the average land-value rise by the average Vancouver household’s 62 person-weeks of work per year (and assuming a 40-hour work week), von Bergmann calculates that the owners of Vancouver houses earned about $126 per hour for what he called “thumb-twiddling.” East of Main Street, the rate was $92 per hour; west of Main, a whopping $173 per hour.

“I am not entirely sure why anyone would want twiddling thumbs to stay so lucrative … or why earnings from thumb-twiddling should remain tax-free [as untaxed capital gains on a principal residence],” von Bergmann said on the MountainMath site.

Not everyone agrees with von Bergmann’s general point, that the speed, scale and taxability of house equity increases demand scrutiny.

It was in February’s throne speech, outlining her government’s agenda, that B.C. Premier Christy Clark made it clear she would “carefully protect the savings and equity that existing homeowners have painstakingly placed in their homes.”

“Painstaking” is not a word many would use to describe the process that last year saw the average price of a single-family home in Metro Vancouver rise by 40%, hitting $1.8 million. •

The Hongcouver blog is devoted to the hybrid culture of its namesake cities: Hong Kong and Vancouver. All story ideas and comments are welcome. Connect with me by email at [email protected] or on Twitter, @ianjamesyoung70.