Natural gas producers in B.C. and Alberta might be getting a break from TransCanada Corp. (TSX:TRP) on their shipping costs – a move aimed at preserving market share in Eastern Canada, where American producers that pay no carbon taxes are increasingly competing with western Canadian producers that do.

Meanwhile, Royal Dutch Shell (NYSE:RDS.A) recently sent out a signal that could bode well for the western Canadian natural gas sector when it published an outlook that predicts the demand for liquefied natural gas (LNG) will outstrip supply sooner than analysts have predicted.

And just last week, Cheniere Energy Inc. (NYSE:LNG) announced a displacement agreement to buy Montney gas from an unnamed Canadian producer in B.C. to supply its LNG export plant in Louisiana. All of which is good news for B.C. and Alberta oil and gas producers.

After TransCanada declared an open-season bid in late 2016 that failed to get long-term commitments from gas producers in Western Canada to move gas on its Canadian mainline, the company decided to offer lower tolling rates. TransCanada is now holding another open season in the hope that lower rates will generate long-term commitments from western Canadian gas producers to take capacity on its underused mainline pipeline, which runs from Alberta to Ontario and Quebec.

In recent years, American gas producers in the Marcellus and Utica shale formations in the U.S. northeast have been eating into western Canadian producers’ traditional markets, including Ontario and Quebec. The American producers not only are much closer to eastern Canadian markets, but also pay no carbon tax, whereas B.C. and Alberta producers do.

“This is what emissions--intensive trade [exposure] really looks like,” said Brad Herald, western Canadian vice-president for the Canadian Association of Petroleum Producers. “This was 15%, or thereabouts, of our total gas volume produced in Canada facing very stiff competition [from a region] that didn’t apply a carbon tax.”

Should companies like Petronas and Shell make a final investment decision on large liquefied natural gas projects on the B.C. coast, it will create a new market for natural gas produced in northeastern B.C. But until that happens, producers in B.C. and Alberta need to at least preserve existing markets.

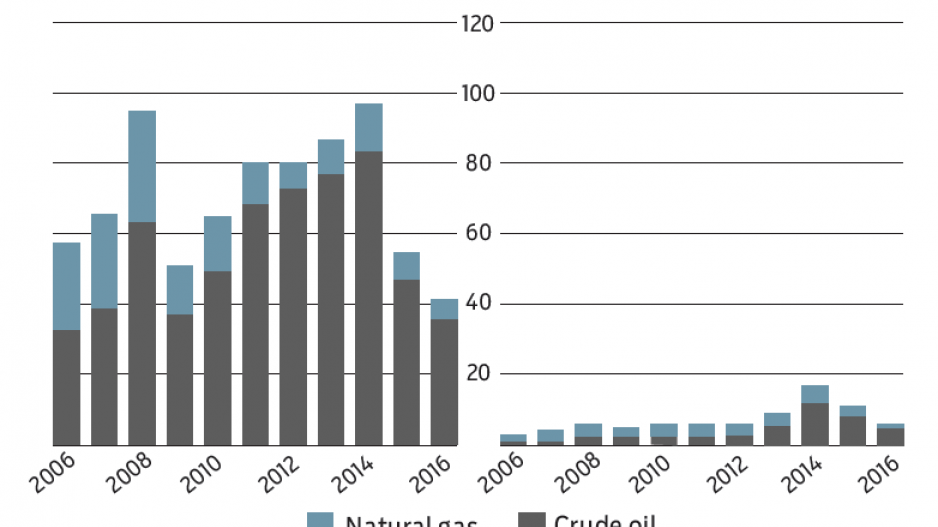

There has been a dramatic shift in gas production in Western Canada in the last six years, with most new production coming out of the Montney formation straddling the B.C.-Alberta border, which is so prolific and so rich in liquids that companies continue to plow billions into the region, irrespective of an LNG industry ever taking off, and despite low North American gas prices.

As David Austin points out, Encana Corp. (TSX:ECA) has told analysts that it now considers the Montney a condensate play rather than a gas play. (Condensate is used to dilute the bitumen produced in Alberta and trades for about the same per-barrel price as crude oil.)

There is so much value in Montney’s light oil, condensate, propane and other liquids that for some companies, the gas they produce is almost a byproduct.

“The point is that the Montney is being developed irrespective of LNG,” said Austin, a lawyer specializing in energy with Clark Wilson LLP.

Six new gas processing plants are under construction in northeastern B.C., and midstream companies are building or expanding pipeline networks, including a $1.1 billion expansion of the Nova Gas Transmission system due for completion in the spring.

Analysts have predicted that a current glut of LNG on the market – thanks to new projects coming online from Australia – means it is unlikely that any large LNG project anywhere in the world will get a final investment decision before 2018 or 2019.

Shell, which in 2015 deferred a final investment decision on its LNG Canada project, recently questioned those predictions.

In a new outlook published on February 20, Shell said the demand for LNG in Asia, particularly China, has been higher than expected, absorbing more of the new LNG supplies faster than expected. In January, LNG imports in China were 40% above what they were one year earlier.

Cheniere likewise recently noted a growth in global LNG demand in 2016 that outpaced expectations: a 6% increase in demand in 2016, mostly from China and India.

“The outlook for LNG demand is set to grow at twice the rate of gas demand, at 4% to 5% a year between 2015 and 2030,” Shell’s outlook states.

Whereas analysts have predicted that the supply glut will not start balancing out until 2025, Shell now puts that date at around 2020. But if Shell does make a final investment decision on its LNG Canada project, it won’t be this year, said Susannah Pierce, director of external affairs for LNG Canada.

When Shell postponed a final investment decision on the project last year, it cancelled its existing engineering, procurement and construction (EPC) contract and issued a request for proposals for a new one. It is now studying EPC proposals from four pre-qualified consortiums.

“That will take about a year to get through that process or more,” Pierce said. “When we really talk about the opportunities for British Columbia we are talking post-2020.”