Two of the world’s largest potash companies are merging under the name Nutrien in a continued trend of consolidation within the industry.

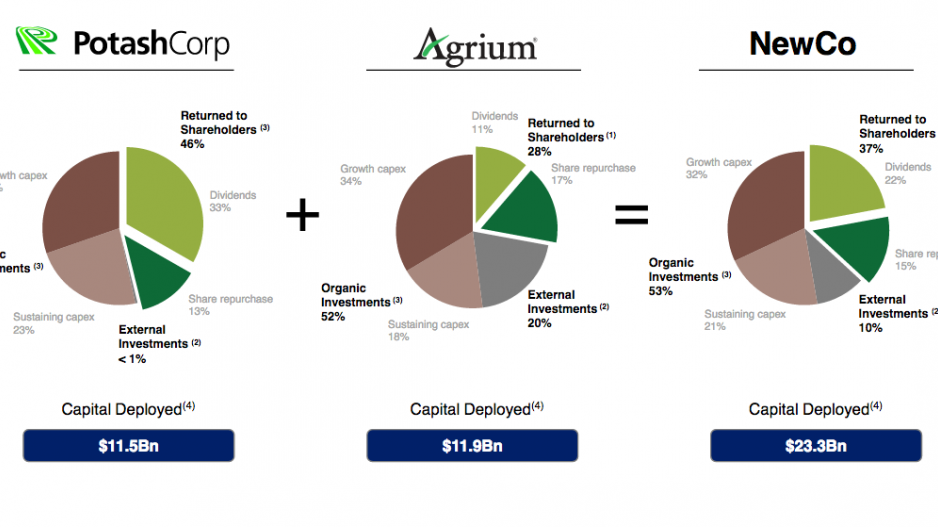

Saskatchewan-based PotashCorp (TSX:POT)and Alberta-based Agrium (TSX:AGU)announced yesterday that they would be merging under the new title in a US$26 billion deal.

In November, shareholders of both companies voted overwhelmingly in favour of the merger. Of the 59% of PotashCorp’s shareholders that voted, 99% voted in favour of the merger. Agrium experienced similar results but had a much greater shareholder turnout at 78%.

The merger could be interpreted as another sign of difficult times for the industry. Earlier this year, Canpotex, an export subsidiary shared by PotashCorp and Agrium, pulled out of British Columbia, closing its Vancouver office and cancelling plans for a terminal expansion at the Prince Rupert Port. Consolidating functions into a single existing corporate structure is a common cost-saving strategy, according to Trevor Heaver, professor emeritus at the University of British Columbia’s Sauder School of Business. PotashCorp has been consolidating various aspects of its business through both combining internal functions as well as mergers.

The cancellation of the port expansion and the closure of PotashCorp’s subsidiary’s Vancouver office are not directly related to the merger, but they are likely symptoms of the same market conditions. A predicted lack of demand in global potash markets is likely the reason for cost-saving measures like cancelling planned spending increases or consolidating offices.

“Basically, they’re both tied to the same general phenomenon that demand isn’t booming as it was hoped to,” Heaver told Business in Vancouver in March.

PotashCorp, the largest potash producer, has had its sales drop 49% from 2011 to 2016 and reported a net income drop of 73% over the same period. Agrium has had a different fate. While sales were down 7% year over year from 2015 to 2016, it has experienced revenue growth of 32%.

“This is probably the only play that they have and this is the time to do it.” Brooke Dobni, a professor at the University of Saskatchewan’s Edward’s School of Business, told the Saskatoon StarPhoenix in September.

The two companies are still waiting for regulatory approval of the US$26 billion deal.