Controversial new U.S. securities rules set to be enacted in early 2013 threaten to affect local mining companies registered on American stock exchanges.

The legislation in the Dodd-Frank Wall Street Reform and Consumer Protection Act requires companies to disclose payments to governments and any minerals coming from Africa’s “conflict minerals” zone.

It will affect all U.S. Securities and Exchange Commission (SEC) registrants and will place new disclosure requirements on some Canadian companies as soon as January 2013.

The Dodd-Frank conflict minerals disclosure requirements are already drawing fire from U.S. business groups; the U.S. Chamber of Commerce and the National Association of Manufacturers recently asked a U.S. federal court to modify or kill the rule. The organizations called the act “unworkable” and “burdensome.”

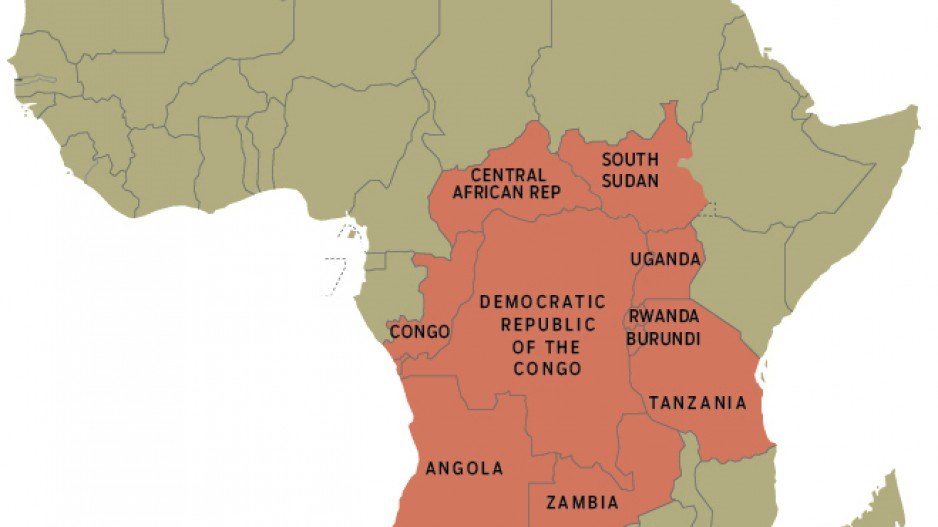

Bruce McIntyre, a partner with PwC’s consulting services, said the conflict minerals rules track the supply chain of gold, tin, tungsten and tantalum coming from the Democratic Republic of the Congo and adjoining countries, where the mineral trade is helping finance armed conflicts.

He said that while the rules are geared at manufacturers and don’t directly require mining companies to disclose where their minerals come from, the mining sector might get hit indirectly by SEC registrant customers.

“All of those [SEC] registrant companies will be reaching back into their supply chain, looking for assertions and data that can support their assertion of whether or not they do have conflict minerals in their products.”

McIntyre added that for a mining company, compliance can be as simple as confirming that it isn’t extracting minerals in the conflict zone. But he said it can also be much more complex in cases where the company is mining in the region or sourcing minerals from the area to, for example, supply a smelter.

“There’s a lot of legitimate mining in this region, so you have to now demonstrate that the payments that you make – either purchasing your materials or even right down to the people you employ in your organization – that that money is not flowing into an armed conflict situation. So it does become quite onerous.”

McIntyre noted that companies need to start tracking the source of their minerals as of January 31, 2013, and reporting them as of May 2014.

PwC tax specialist Garry Engsaid local mining companies who are SEC registrants will also need to comply shortly with Dodd Frank disclosure requirements for payments to government, including taxes, royalties and licences.

He said the legislation’s goal is to allow a country’s citizens to track and be aware of the type of payments governments are receiving, so they can ensure wealth or revenue is being shared equitably with them.

Eng added that while the rules about payments to government currently only apply to SEC registrants, there’s a broader industry trend that might soon hit non-SEC registrants.

He noted that the Mining Association of Canadaand other national mining groups recently signed a memorandum of understanding with some NGOs in a bid to improve Canada’s transparency practices regarding company payments to government.

Eng said reporting those payments is a fairly mechanical process, but that companies subject to the Dodd-Frank rules might need clarity on payments to First Nations and other grey areas.

“Is it possible that [those payments] could be caught [by the legislation]?” he said. “I don’t think the SEC is even clear on that.”

Eng said companies will need to seek clarity from the SEC over any uncertainty they might have about interpreting the rules. He noted that companies subject to the rules will need to report any government payments made after September 30, 2013. •