Rize in transit

A public hearing for the rezoning application for Rize Alliance Properties Ltd.’s planned tower at Kingsway and Broadway – billed by some as Vancouver’s biggest ever – resumed last week, a month after its first night.

Rize Alliance president Will Lin has frequently pointed out that 51% of correspondence city staff has received from the public supports the rezoning, though close to 2,500 signatures have been collected on petitions opposing the project (versus approximately 700 in favour). Lin – who did not return a call for comment last week – has been keen to mention that increased density at the site will support a transit hub at Main and Broadway as part of the planned rapid transit line to UBC. The transit station is among the reasons the Rize site is one of three selected for greater density in the Mount Pleasant community plan.

Curiously, community opposition to what Rize plans contrasts sharply with support for a new transit line that would stop at Main and Broadway.

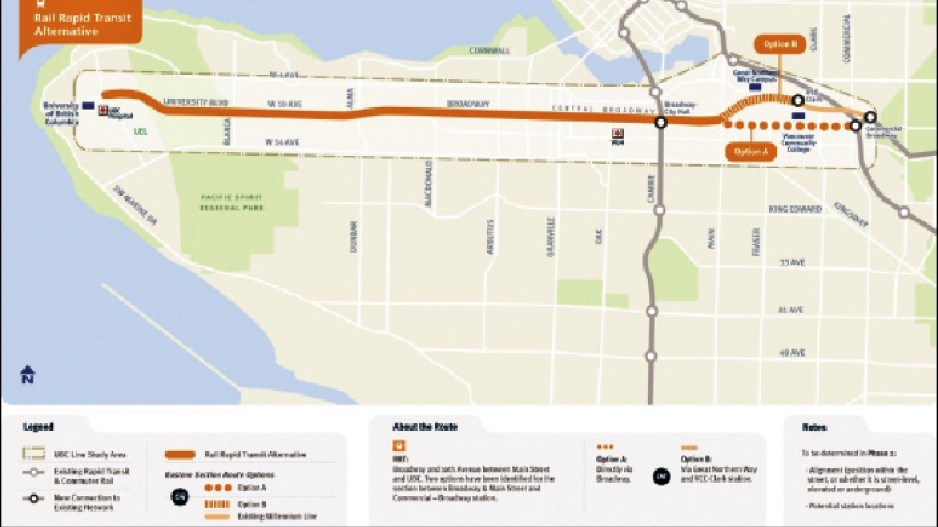

Responses to various TransLink proposals last year fell heavily in favour of a rapid rail transit option that would run from either the Commercial-Broadway or VCC-Clark SkyTrain stations west along Broadway. Routing from VCC-Clark would see Main and Broadway be the line’s first stop on Broadway.

The rapid rail line drew 76% support, with just 14% of respondents opposed.

Whether the fourth night of the Rize public hearing on April 4 will shift public opinion toward similar support for what Rize proposes is another question.

More engagement

Still on the public engagement beat, Concert Properties Ltd. and Ivanhoe Cambridge hosted public information sessions last Thursday on the future of North Vancouver’s Harbourside business park and Oakridge Centre in Vancouver, respectively. (A report on the latter will appear here next week.)

Concert’s plans for Harbourside have changed significantly since it acquired the 65-acre Fullerton fill site with Knightsbridge Properties Ltd. in 1998. Concert initially proceeded with Harbourside Business Park, which now has approximately 885,000 square feet of office and light industrial space, but it is now seeking a rezoning that would allow a mix of uses including residential to complement the existing commercial space.

“This came up because of weak demand for commercial on the waterfront sites,” said Farouk Babul, development manager for Harbourside with Concert. “Given the city’s sustainability objectives, we thought there would be a higher and better use for a waterfront site.”

While the site’s capacity for commercial development is being retained, Concert is seeking zoning to allow up to 800 residential units on 12 acres of waterfront property.

A hotel was originally planned for the property, but financing proved challenging.

Babul said the new plan will contribute to a more dynamic waterfront in North Vancouver, meshing with the city’s plans for its western waterfront properties. April 12 and 30 town-hall meetings to gather public input have been scheduled to follow last week’s information session.

North Van loosens

First-quarter CBRE Ltd. statistics show a general drop across the region in office and industrial space. Vacancies in downtown office space ended the quarter at 3.4%, unchanged since 2011’s final quarter, while the regional tally was 7.6%, down 0.4 percentage points from the previous quarter. Vacancies also dropped 0.4 percentage points in the region’s industrial premises, ending the first quarter at 4.4%.

A consistent exception to the downward trend was the North Shore, where office vacancies rose 1.3 percentage points to 7.5% and industrial vacancies increased 1.2 points to 4.4%.

But the uptick in vacancies is hardly cause for worry.

The availability of industrial space on the North Shore remains the lowest in the region at just 5.4%, which CBRE sales associate Mehdi Shokri attributes to the demand by owner-users for space.

He said vacancies typically increase when new space becomes available for purchase. The recent conversion of Lions Gate Business Park on Welch Avenue to strata will boost vacancies in leased space, he said, as stronger tenants make the leap to ownership.

“Whenever there’s any signs of an increase in sales product, typically there’s a correlation … [where] leasing starts to slow down,” Mehdi said. “Good tenants can support buying a building … therefore they’re logically going to find something to buy, if they can.”

Recent offerings have also helped boost office vacancies, as tenants shift into more efficient space and leave lower-quality space on the market. Mehdi believes this will create opportunities for landlords to upgrade C-class space to compete with new office projects such as those along Lonsdale Avenue by Wesgroup, Onni and others. •