US President Mitt Romney will spend 2013 getting the U.S. economy back on track and resuscitating America’s housing market, or at least that’s what Robert MacDonald’s gut tells him will happen.

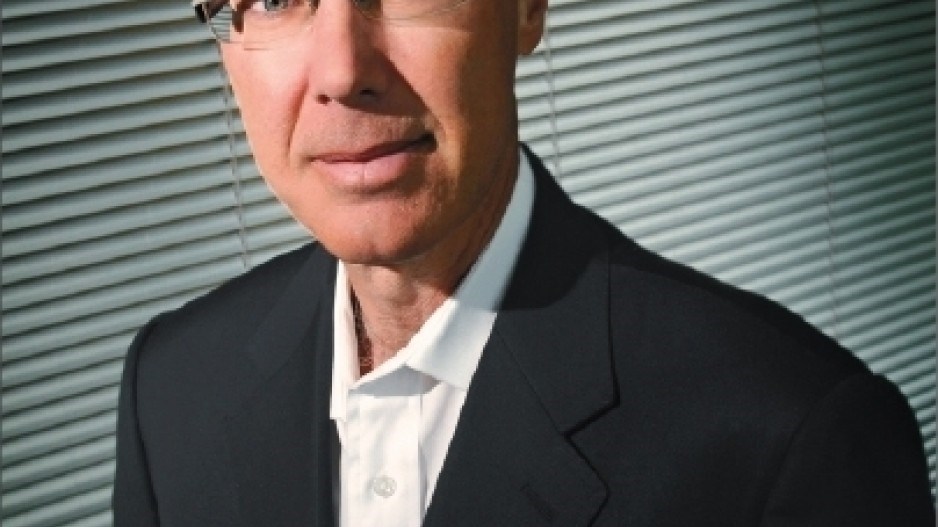

Dressed in a dark power suit and a casually unbuttoned white shirt, the MacDonald Development Corp.owner exudes the confidence of a man who has a habit of being right about political trends and capitalizing on their economic consequences.

MacDonald is developing about $300 million worth of projects in Alberta and another $200 in B.C. and Washington state.

His major Vancouver real estate projects include:

•the $250 million Capitol Residences on his former Capitol 6 site on Granville Street, along with Wall Financial Corp. (TSX:WFC);

•the $200 million Hudson Condominiums project, and

•the Murchies building in Yaletown.

MacDonald has gradually been shifting the focus of his three-office, 30-employee company to projects outside B.C.

He expects the New Democratic Party to win the next provincial election when the upstart BC Conservative Party splits the free enterprise vote with the BC Liberal Party.

So MacDonald is preparing for what he believes is a natural consequence of a social democratic government: “economic disaster.”

The 55-year-old was in his early 30s when he became convinced that Mike Harcourt would lead the New Democratic Party to its first provincial election win in 19 years in 1991.

“I immediately shut down 50% of our business in the province,” MacDonald said before repeating the word “immediately” and snapping his fingers for effect. “I knew the province was going to go downhill.”

When Glen Clark led the NDP to power in the 1996 provincial election, MacDonald sold his remaining B.C. properties and focused on buying apartment buildings along the U.S. west coast.

He also started investing in Ontario because Mike Harris’ Conservative government had won power there after what MacDonald describes as a “disastrous” time under former Ontario premier Bob Rae.

The result, MacDonald said, is that he missed much of what he considers a lost decade in B.C. and, instead, made a lot of money in the U.S.

The Canadian dollar hovered around US$0.86 in 1990 and had fallen to an average of about US$0.65 in 1999.

“He was smart, very quick to learn and intuitive,” John Windsor remembers, when prodded to think back to what MacDonald was like as a twenty-something.

Windsor hired MacDonald in May 1990, after MacDonald graduated from the University of British Columbia with a commerce degree and a major in urban land economics.

“Some people are smart, but they’re not intuitive,” said Windsor. “There’s a world of difference. Robert could smell when a negotiation had potential.”

It didn’t take keen intuition to predict that the BC Liberal Party was likely to win the 2001 election. So in the lead-up to that election, in which the Liberals won 77 of 79 seats and Gordon Campbell became premier, MacDonald again began investing in B.C.

“The way you can catch the best market timing, if you’re to be in the acquisitions and dispositions business, is to really pay attention to politics and government policy,” MacDonald said. “On a macro level, you must simply avoid being in a down cycle, and you want to capture the early beginnings of an up cycle.”

MacDonald moved from being Windsor’s assistant at North American Land Corp. to being one of the company’s brokers. Despite earning $600,000 in commissions in the recession years of the early 1980s, MacDonald yearned to learn new things.

He took a pay cut to join friends at Strand Development Corp., where he learned the acquisition side of real estate wheeling and dealing.

But he also had a serious medical wake-up call. In 1985, he was diagnosed with lymphatic cancer. He battled back, and the next year decided to leave Strand to become his own boss.

Doctors told him to reduce his 70-hour work weeks or the stress would kill him. He started exercising more and has become a firm believer in the value of eating well, working out regularly and getting enough sleep.

As to the current real estate landscape in Metro Vancouver, MacDonald is less than bullish.

“The market here is higher than, I think, it deserves to be.”

He added that prices will stay flat for a while because Vancouver homes are leveraged less than in other cities.

“If you just bought something for $5 million and you paid cash, you’re not likely to sell it for $4 million. Why would you?”

Outside work, MacDonald has been an influential force in creating events to help British Columbians keep fit. He worked with the B.C. government and his longtime bankers at the RBC Royal Bank to create and sponsor the RBC GranFondo Whistler bike ride between Vancouver and Whistler in 2010.

Elsewhere his community involvement has included board posts at the Urban Development Institute (UDI) and Royal Columbian Hospital. He still sits on the board of St. George’s School.

MacDonald also allocates time for speaking engagements like the UDI’s upcoming event in September for members younger than 40.

“You can boil most real estate company failures down to two things: having too much leverage and too much hubris.

“Act with honesty and integrity and treat others the way you would expect to be treated yourself. That’s the golden rule.” •