Neovasc Inc. (TSX:NVC; Nasdaq:NVCN) has been coasting on success earned in January, when surgeons at St. Paul’s Hospital successfully implanted one of the company’s Tiara devices into a patient to fix a leaky heart valve without requiring open-heart surgery.

It was only the second time that doctors had done such an operation.

Surgeons have used similar devices for years to fix problems in the aortic valve, but only once before in the mitral valve via catheter.

Neovasc’s shares, then listed on the TSX Venture Exchange, jumped 35% post-operation and are up more than 400% in the past two years.

That success helped Neovasc land a $25.2 million bought deal equity financing in March. The company debuted on the Nasdaq exchange in May and graduated to the TSX big board in June.

“Neovasc has a material shot at being a major player in a sea of giants in an important cardiovascular market, but there’s a long way to go,” said Euro Pacific’s Doug Loe, who is the only analyst to cover Neovasc and has the stock listed with a buy rating.

“Best-case scenario is that Neovasc’s device gets approved and launched by late 2019, which is aggressive and assumes that everything goes right between now and then.”

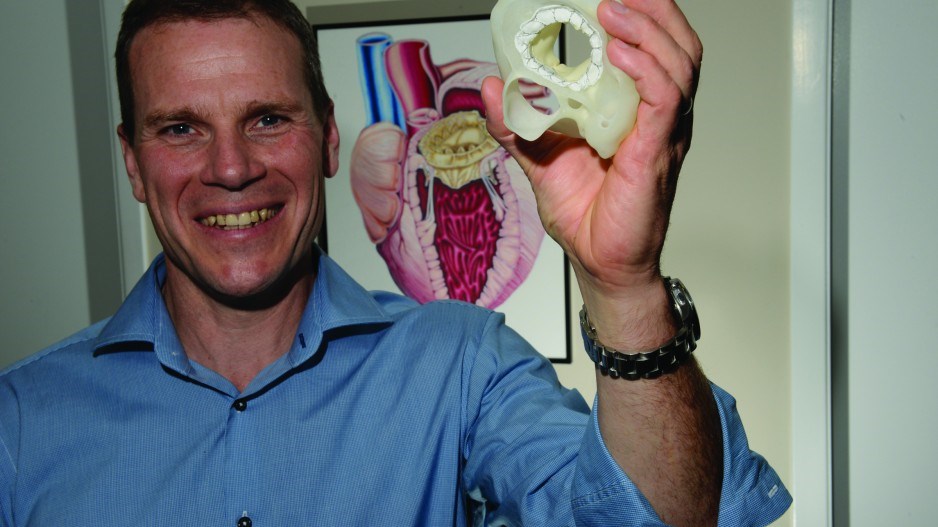

With that success, Neovasc has become a target, Neovasc’s CEO, Alexei Marko, told Business in Vancouver.

Privately held Irvine, California-based CardiAQ Valve Technologies sued Neovasc in June in Massachusetts District Court alleging that Neovasc committed “fraud, misappropriation of trade secrets, breach of contract and unfair and deceptive trade practices.”

Marko dismissed CardiAQ’s claims.

“Unfortunately the medical device space is one that tends to be littered with [lawsuits],” he said. “Whoever is at the lead of the pack unfortunately gets suits filed on them by all the folks who aren’t.”

Neovasc plans to start clinical trials on its Tiara device this fall.

Loe said the health-care niche in which Neovasc competes is “a blockbuster market” with several players, including sector leader Edwards Lifesciences.

The challenge for all competitors has been how to make a valve that was stable enough to be “smooshed up into a geometry that would fit on the tip of a catheter so you could administer it.”

The St. Paul’s Hospital patient who received Neovasc’s mitral valve prosthetic earlier this year has since died. Loe, however, said that his understanding is that the patient did not die from issues related to the Tiara device.

“Anyone who enrols in any of these first-in-human studies is very sick and probably only has weeks to live,” he said. “If I had severe mitral regurgitation and I had any other option that could prolong my life materially, I’m not sure I would subject myself to an experimental medical procedure if I didn’t have to.”

An August 17 INK Research report revealed that Neovasc insiders have sold a net value of shares worth $5,411,260 in the past year. •