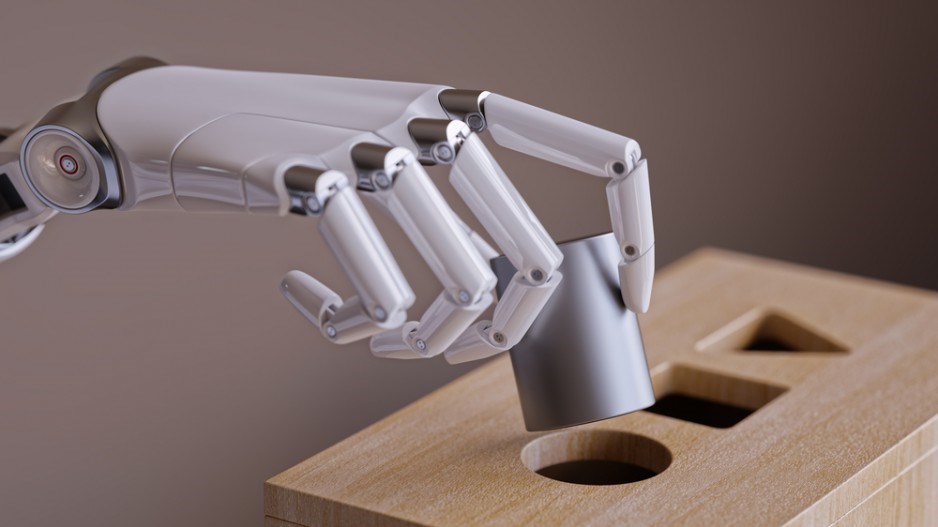

Robots, self-driving cars – those will be the headline grabbers in 2018 when eyes turn to artificial intelligence (AI), according to Mack Flavelle.

“But most of the major advantages will be far more subtle and not consumer-facing,” said the Axiom Zen technology expert specializing in virtual reality, AI and blockchain.

So should retail investors sink money into startups proclaiming they are the next big AI innovators?

Flavelle, whose Vancouver-based innovation studio offers support to early-stage companies similar to an incubator, cautioned that startups might market their use of AI or machine learning “simply to catch a ride on the hype train.”

Duncan Stewart, director of technology, media and telecommunications (TMT) research for Deloitte Canada, said machine learning will enter 2018 finally looking “ready for prime time.”

Machine learning is the application of AI that gives computers access to data to learn independently and improve based on experience. No human programming is required.

Deloitte’s annual TMT predictions report forecasts that advances in computer chips will allow companies to harness machine learning using less power at less cost.

“At the enterprise level, a lot of the things that made machine learning hard to use last year are going away,” Stewart said.

By the end of 2018, more than 25% – or 300,000 – of chips used to accelerate machine learning in data centres will be either field- programmable gate arrays or application-specific integrated circuits.

“If the only accomplishment of these new chips is to make machine learning 10, 100 or 1,000 times less expensive, that could be more revolutionary than it seems,” the report said. “But on their own, they are not likely to give better or more accurate results.”

The report estimates the number of implementations and pilot projects using machine learning will double compared with 2017 and will double once again by 2020.

And while Stewart acknowledged AI and machine learning could result in job losses over time, he said most companies with which Deloitte has consulted are pursuing these technologies for the purposes of augmentation rather than automation.

On the other end of the spectrum, Stewart said he expects growth in virtual reality (VR) to disappoint the tech’s biggest champions in 2018.

“They’re struggling, they’re absolutely struggling,” he said.

Deloitte estimated sales last year of high-end hardware for VR totalled $800 million to $1 billion.

“This year, they are maybe $1.5 [billion], if that. Everybody’s cutting prices; volumes are low,” Stewart said.

“For a technology in Year 2 of its existence, going from $1 billion in hardware to a $1.5 [billion], that’s really low growth.”

Victory Square managing partner Ray Walia said that while augmented reality (AR) is overtaking the hype of virtual reality, he still expects the latter to remain dominant.

“It’s that deep, rich experience you’re going to get through VR that can’t be done in the existing world,” said Walia, who is also CEO of Vancouver-based incubator Launch Academy.

“VR came out of the gates and every one was wowed and mesmerized, but the hard reality is that there’s just not enough headsets or devices available for in-home use.”

Walia said the beauty of AR is that it’s accessible through smartphones, making mass adoption easier.

He said enterprises will turn their attention in 2018 towards monetizing AR, perhaps best known for Pokemon Go gaming and Snapchat filters that morph users’ faces.

“This is not something where you’re going to magically have a total AR experience in your organization,” Walia said.

“But there is a way to start to integrate that technology into your marketing departments and thought process so that you’re coming up with new strategies and new campaigns.”

The Deloitte TMT report forecasts more than one billion smartphone users will create AR content at least once next year, with app revenue for AR content projected at less than $100 million globally.

Flavelle said software development tools such as Apple’s (Nasdaq:AAPL) ARKit and Google’s (Nasdaq:GOOGL) ARCore will further drive massive adoption as it gets easier for developers to build compelling AR experiences.

But as mass adoption of AR continues in 2018, Walia said adoption of blockchain, the technology underpinning cryptocurrencies like Bitcoin, will be slower.

Many people remain wary of Bitcoin, but the technology backing it is considered sound.

Blockchain serves as an electronic ledger of sorts that cannot be manipulated, unlike cryptocurrency exchanges, which have proven vulnerable to hackers.

As recently as December, hackers stole US$64 million from a Slovenia-based digital marketplace.

But beyond cryptocurrencies, Walia said by the second half of the year more enterprises will use the technology to improve how data and information are managed.

“What you’re going to see is a lot of technologies come out that’s going to make it more streamlined and compatible with existing legacy infrastructure,” he said.

“You’re not going to realistically expect them to rip out their entire IT infrastructure and start doing everything with blockchain. But you’re going to start seeing technology that can come in and bridge that.”

@reporton