Three years ago, when Jerry Kroll learned about the nutritional and pharmaceutical applications of microwave dehydration technology commercialized by EnWave Corp. (TSX-V:ENW), he decided to invest in the company.

He was especially impressed with the health applications of EnWave’s Radiant Energy Vacuum (REV) technology for extending the shelf life of vaccines.

So when he learned recently that EnWave had signed an agreement with R.J. Reynolds Tobacco Co. to use EnWave’s technology for dehydrating tobacco, he was dismayed. Under the agreement, Reynolds has been granted an option to license EnWave’s REV technology for the exclusive use of dehydrating tobacco products in the U.S., according to a company press release.

“I couldn’t think of a worse 180 than what they’ve done here,” Kroll told Business in Vancouver.

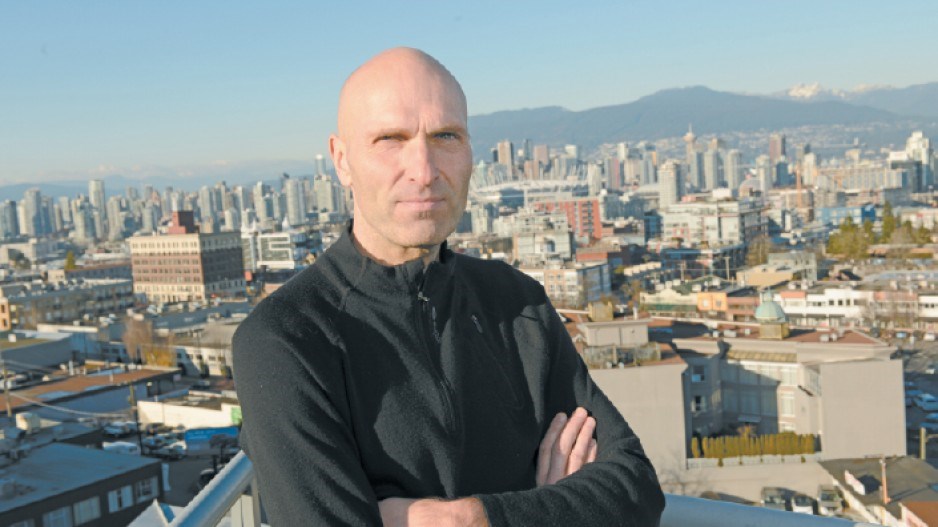

Kroll is the former CEO of Naturally Advanced Technologies Inc. – now Crailar Technologies Inc. (TSX-V:CL) – which developed a process for turning flax into textiles as an alternative to cotton, and remains an investor.

He said he invests in “anything that’s good for people, planet and profit. I’m not a philanthropist, and EnWave is not a philanthropic endeavour. It needs to make money. But you don’t make money off of other people’s misfortune like that. That’s just not cool.”

The technology EnWave commercialized was spun out of the University of British Columbia. It uses microwaves in a vacuum at low temperatures to dehydrate food, pharmaceuticals and vaccines and is used as an alternative to freeze-drying.

The company’s founder, Tim Durance, developed the technology while he was a professor in UBC’s food, nutrition and health food science department and in 2012 won a LifeSciences BC Innovation and Achievement Award.

Reached by phone, Durance declined to comment on the controversy, except to say he wasn’t even aware that Kroll had raised the issue with the company.

“We’re working with a lot of companies,” he said, “and we don’t comment on projects that we’re working [on] with our customers.”

Kroll believes using EnWave’s technology for tobacco is inconsistent for a company that began with an emphasis on life sciences and nutrition.

“Tobacco is the only product in the world that, if you use it the way it’s intended to be used, it will kill you. And these guys are helping make it a more useful product?”

Kroll contacted the company to express his concern and said he was told that the company was trying to increase value for shareholders. EnWave’s stock was trading at around $1.50 last week – more than double what it was when Kroll first invested in the company.

But Kroll does not want to see the company’s value increased if it means using EnWave’s technology to improve tobacco products.

“Cases like this come up all the time,” said Deb Abbey, executive director for the Responsible Investment Organization. “Companies develop new relationships with other businesses, and it changes the fundamental nature of that investment for that investor.”

Tobacco and nuclear power are two sectors many institutional investors steer clear of, due to the ethical questions, Abbey said.

“A lot of pension funds and other funds in North America simply don’t invest in tobacco – even funds that are not considered responsible investment funds,” Abbey said.

In some cases, if enough investors disagree with the direction a company has taken, they can bring enough pressure to bear to force a change of direction. If that doesn’t work, investors can vote with their feet. Last year, after raising concerns with Enbridge Inc. (TSX:ENB) that it was not taking the risk that First Nation opposition to Northern Gateway pipeline posed seriously enough, Ethical Funds divested itself of all investments in Enbridge.

Kroll said he plans to do likewise with his EnWave stock if the company doesn’t have a change of heart.

“If they don’t change their mandate to work with R.J. Reynolds – or any tobacco company or do anything just strictly for a buck – I will sell my stock and I’m pretty sure others will,” Kroll said. •