A Vancouver-based financial technology company is getting some big-time dollar recognition in its own backyard.

Finn AI announced October 22 it’s raised $14 million in a Series A financing round led by Cascadian investors Yaletown Partners and Flying Fish Partners.

Yaletown Partners is based in Vancouver, while Flying Fish calls Seattle home.

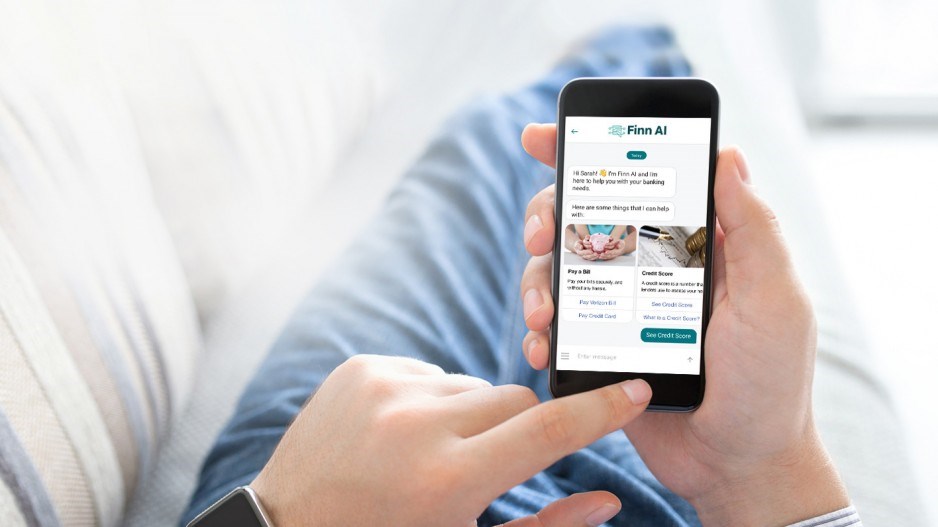

Finn AI is best known for developing a virtual banking assistant that uses artificial intelligence.

The financing round also featured new investors 1843 Capital as well as BDC Capital’s Women in Technology Venture Fund.

Undisclosed angel investors provided additional investment.

"We've seen great progress in our business over the last twelve months, doubling our team to over 50 across North America and acquiring a number of major new customers and partners," CEO Jake Tyler said in a statement.

The company said it plans to use the $14 million to help its virtual banking assistant support additional features for existing customers, including the Bank of Montreal and ATB Financial.

The investment dollars will also see two new additions to Finn AI’s boardroom: Eric Bukovinsky, a partner at Yaletown Partners, and Flying Fish managing partner Frank Chang.

"Banks around the world are rapidly adopting conversational AI to deepen relationships with customers, drive sales and migrate routine, high volume tasks and queries to digital self-serve channels" Bukovinsky said in a statement.

"Finn AI has proven it can deliver with major banks across North America, Europe, Africa and Latin America. We're excited to support them in this next stage of their growth."

Meanwhile, the company said that interest from BDC Capital Women in Technology Fund was “driven in part by the leadership” of Finn AI co-founder and chief operating officer Natalie Cartwright.

"Along with a strong leadership team, we believe that Finn AI is building a globally competitive business that will deliver strong returns - exactly what our investors expect from any of our investments," Michelle Scarborough, the managing director BDC Capital’s Women in Technology Venture Fund, said in a statement.