Canucks on ice

High household debt and weaker job prospects are helping cool U.S. property buying for many Canadians, speculates Sal Guatieri, senior economist for BMO Bank of Montreal in Toronto.

A recent Leger Marketing survey for BMO indicates that buying U.S. property is of interest to 16% of Canadians. A year ago, 20% of Canadians would have considered a U.S. property purchase.

Guatieri attributed the drop in interest to skepticism that the U.S. market has hit bottom, particularly in Florida, a popular destination for snowbirds in Eastern Canada.

“There’s a general sense of, ‘What’s the rush?’ given such a high foreclosure rate and prices still softening,” he said.

Other factors cooling interest in U.S. residential property investment reflect Canada’s economy.

“Higher household debts in Canada [are] perhaps curbing either home equity extraction or mortgage growth here, funds that could be used to buy real estate in the U.S.,” Guatieri said. “A third factor is just a weakening trend in employment in the second half of last year. A modest upward turn in the unemployment rate has probably discouraged some Canadians from buying U.S. real estate.”

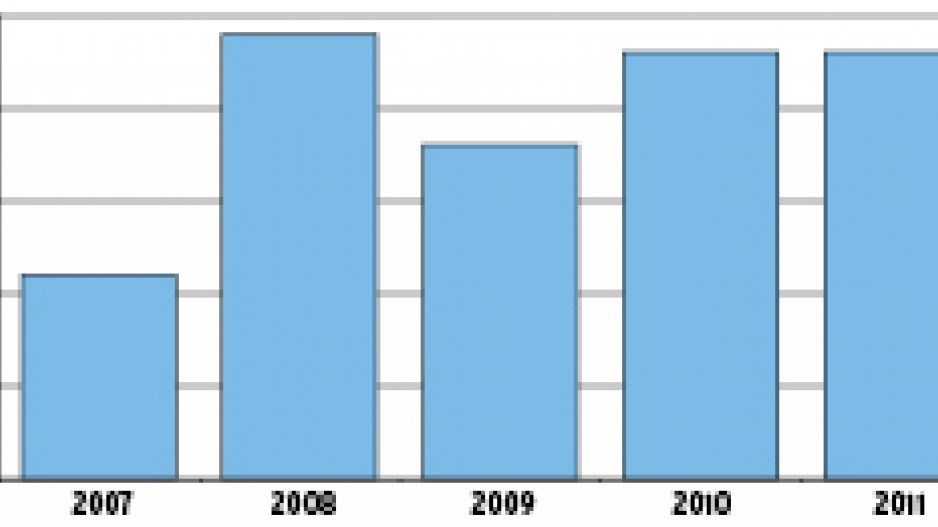

On the whole, however, the U.S. property market remains an attractive place for buyers from Canada. Statistics from the National Association of Realtors in the U.S. indicate that participation by Canadians has more than doubled since the mid-2000s, fuelled in part by the high-flying loonie.

Canadians accounted for 11% of activity in the U.S. property market in 2007, Guatieri said, while in 2011 the proportion was 23%.

“It’s really hard to discern a trend from the last five years,” Guatieri said, “but my presumption is that compared to a decade ago, when the Canadian dollar was so much lower, that the share of Canadian purchases has increased.”

Affordability improves

BMO may feel the employment picture might have dampened U.S. investment intentions, but a new RBC Economics report tags job creation and rising incomes with improving housing affordability in the province.

“The provincial market registered the most significant reduction in homeownership costs among the provinces,” the report stated.

Buying a detached bungalow in B.C. required just 67.7% of household monthly income on average at the end of 2011, down 2.5 percentage points from the third quarter.

A condo requires 35% of household monthly income, close to the 32% threshold that constitutes the standard measure of housing affordability.

While improvements were also noted in Vancouver, RBC bluntly acknowledged, “Unaffordability has long been a fact of life in the Vancouver housing market.”

It doesn’t see that changing any time soon and warned that the circumstance “will continue to drive local buyers away.”

Detached bungalows posted the greatest improvement, with affordability improving 4.6 percentage points to require just 86% of monthly household income. But it’ll still require 92.3% of monthly household income to afford a two-storey home in the city.

Good intentions

Statistics Canada reports that B.C.’s housing industry could see investments rise 7.3% in 2012, reaching close to $14.4 billion – $750 million more than last year.

All told, public and private spending in B.C. could total $50.8 billion in 2012, up 10.1% from 2011. Housing is the single largest area of capital expenditures, according to StatsCan’s annual survey of public and private investment intentions.

Of course, StatsCan said the same thing last year, predicting that B.C. homebuilders would spend $14.9 billion. In fact, preliminary figures indicate that housing investments in 2011 totalled just $13.4 billion, lagging by $3 million the total spent in 2010.

Construction firms are set for a positive showing in 2012, with total capital investments of $822.2 million, up 4.7% from estimated investments last year of $785.4 million.

Real estate, rental and leasing companies plan capital investments of $1.75 billion in 2012, up 2.5% from last year. The increase is driven largely by construction spending, which StatsCan estimates will hit $493.8 million, leaping 21.8% from last year. •