The future of Parq Vancouver casino is under the microscope as questions arise over whether its owner is able to service its debts.

The Parq Vancouver casino’s owner, Parq Holdings L.P., and that company’s shareholders – majority-owner PBC Group, and Dundee Corp. (TSX:DC.A) – all refused to tell Business in Vancouver or issue any public statements on May 1 to say whether debt-laden Parq was able to make a key April 30 interest payment related to its US$415 million project financing that dates back to 2014.

Those entities were also quiet on whether a corporate restructuring at Parq, which would have involved a new investor coming to the table, was able to take place in order to help the company make that payment.

S&P Global Ratings downgraded Parq Holdings L.P.’s credit rating to a dismal CCC, from B- on April 15.

“The downgrade reflects our view that Parq’s inability to meaningfully improve its profitability against a high and expensive debt burden will continue to pressure liquidity, and eventually make the company vulnerable to a balance-sheet restructure,” the ratings agency said at the time.

Dundee CEO Jonathan Goodman told investors in a March 29 conference call to expect a restructuring at Parq and that he was not keen to put any new money into the venture. He said that he was “hoping” that Parq could complete a transaction “before the end of April” with an a third party, which at the time had to remain confidential.

Dundee CFO Robert Sellars said on the same call that he expected that were such a transaction to complete, Dundee’s stake in Parq would fall to between 22% and 25% from the current 37%.

PBC Group, in contrast, has been upping its stake in Parq. In February, PBC Group bought former co-owner Paragon Gaming’s minority stake in Parq to bring PBC Group’s stake in Parq up to 63%.

Las Vegas-based Paragon had been involved in the downtown Vancouver casino business since 2006, when it acquired Edgewater Casino, the only licensed casino that operated in the city. Paragon then failed in its attempt to get city hall to allow it to expand Edgewater’s operations.

Nonetheless, Paragon managed Edgewater for more than 10 years before it relocated its casino in September 2017 to the new Parq Vancouver resort complex that is bookended by two Marriott-owned hotels and has eight eateries and a 63,000-square-foot conference centre.

The two-level, 72,000-square-foot casino has 600 slot machines and 75 game tables and is operationally profitable before debt-servicing costs are added in, M Capital Partners Inc. research analyst Andrew Hood told Business in Vancouver on May 1.

This is despite various new anti-money laundering rules that the B.C. government has put in place. Casino operators, such as Great Canadian Gaming (TSX:GC), have cited those new rules in conference calls as being partly responsible for lower revenue.

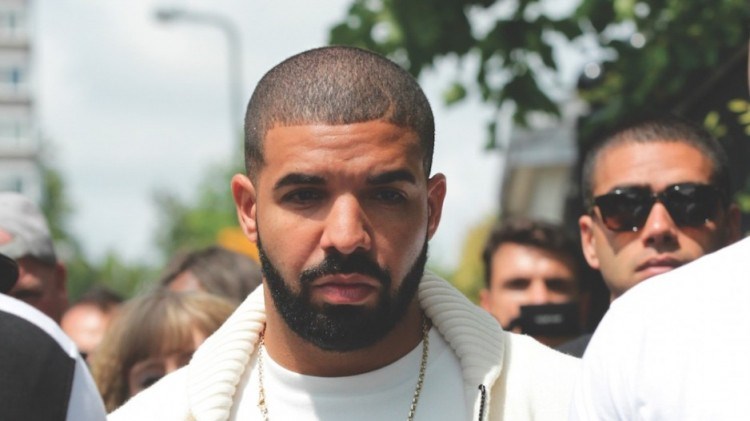

Operations are profitable even in spite of a bout of bad publicity stemming from claims from Toronto rapper Drake last November that he was “profiled.”

“Parq Casino @parqvancouverbc is the worst run business I have ever witnessed...profiling me and not allowing me to gamble when I had everything they originally asked me for,” said Drake said in a social media post.

(Image: Rap star Drake called the Parq Vancouver casino “the worst-run business I have ever witnessed ... profiling me and not allowing me to gamble when I had everything they originally asked me for” | Twocoms/Shutterstock)

Annual revenue at Parq is in the $170-million range while expenses are in the $150-million range, according to Hood.

“You take out $112 million in interest and that then takes you negative, but operationally they are making money,” he said.

Indeed, the problem for the casino’s owners is that they are losing money hand over fist related to initial project-financing debt and various loans since that time that have different interest rates – some of which are not public.

Dundee last year wrote down approximately $124 million because of its investment in Parq, according to Sellars.

Goodman stressed on the conference call that the company has stopped pumping money into Parq.

“Recognize, we haven’t put any money in, in June, in September or December into Parq,” Goodman said. “So we’ve already recognized that we’re reluctant to throw money in it.”

Statements like Goodman’s have convinced Hood that Dundee is unlikely to have supported taking on more debt to finance the April 30 interest payment, which had already been deferred by a month.

Hood believes that instead, it is likely that PBC Group would have fronted the money.

“They increased their position to 63% [of Parq] in February so I can’t see them letting [Parq] go into receivership when they just doubled their position,” he said.

BIV asked PBC Group’s CFO Roch Brisson if his company helped Parq make the interest payment but he said “I think we already indicated that there is no comment. We’re a private company.”

Were Parq to dissolve and the casino were to close it is likely that the Marriott’s two hotels – the 188-room Douglas Autograph Collection hotel and the 329-room JW Marriott hotel – would continue to do a brisk business.

That is not only because the site has convention space and is connected to B.C. Place Stadium, but also because Vancouver has been steadily losing hotel rooms to redevelopment, thereby pushing occupancy rates up.

City of Vancouver statistics show that the city in mid-2018 had 13,925 hotel rooms, or 1,105 fewer units than it did a decade ago. Those lost rooms include the 626 suites in the former Empire Landmark and Coast Plaza Stanley Park hotels, which both closed in recent years.

Tourism Vancouver CEO Ty Speer underscored the need for the city to have more hotel rooms while on an April 30 panel presented by the Urban Development Institute. He said that hotel space downtown is so scarce that hotels are sometimes able to charge exorbitant sums for rooms, such as last year on October 2, when Beyonce and Jay Z performed a concert at B.C. Place.

“For a Tuesday night in October, a two-star property was charging $450 per night for a room,” Speer said. “Tuesday or Wednesday nights in October are not the most exciting tourism opportunities in a normal calendar [unless] a major event happens.”

Marriott Canada president Don Cleary was also bullish enough about his two new hotels in the Parq complex when they opened that he told BIV that he was interested in opening several new luxury hotels in Vancouver, perhaps under brands such as W or Ritz Carlton.

Any closure of the Parq casino would also likely have the effect of giving a bump to competitors such as the River Rock Casino Resort in Richmond that Great Canadian Gaming owns.

Great Canadian Gaming saw revenue last year at its five B.C. casinos fall 3% to $268-million.