In less than a week, the way auto insurance works in British Columbia will fundamentally change. With the move to Enhanced Care, auto insurance is about to become much more affordable while also providing significantly improved care and recovery benefits for anyone injured in a crash.

Starting May 1, 2021, customers with full ICBC basic and optional coverage will save, on average, 20 per cent on their annual premiums. Customers with policies renewing May 1 or shortly after have already been able to renew under Enhanced Care.

ICBC customers can go to icbc.com/enhancedcare today to find out their own savings using an online estimator tool. In addition to annual savings, many British Columbians will also be eligible for a one-time, pro-rated refund for however long their current policy extends past May 1.

Also starting May 1, all British Columbians – regardless if they are a driver, passenger, pedestrian or cyclist – will automatically be protected under Enhanced Care if they’re injured in a car crash in Canada or the United States.

As a care-based system, Enhanced Care marks a significant shift to the way ICBC works with injured customers. Notably, ICBC will no longer be working in a tort-based, adversarial system – one focused on legal costs and cash-based compensation.

In today’s system, ICBC’s role is to help those injured in crashes get the benefits they need while also balancing the reality that half of injured customers may sue another ICBC customer as part of the process.

Under Enhanced Care, ICBC’s recovery specialists will be focused solely on helping each injured customer get the care they need. ICBC has wholeheartedly embraced this significant shift, with staff training informed by valued stakeholders in the healthcare, disability and medical fields.

The improved benefits, known as Enhanced Accident Benefits, will pay for medical care and recovery treatments, including physiotherapy, chiropractic care, medical equipment and other supports and services, to support you if you’re injured in a crash.

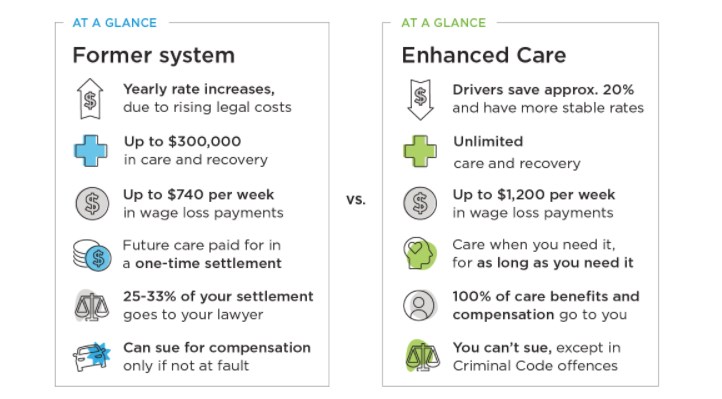

Comparing today’s Autoplan insurance with Enhanced Care. ICBC’s new insurance model takes effect on May 1, 2021.

To ensure you can continue to pay your bills if you’re injured in a crash and unable to work, Enhanced Care will also provide an income replacement benefit to cover your lost wages. This benefit will cover 90 per cent of your net income up to a maximum of $100,000 gross income –a 70 per cent increase in maximum benefits over today. Anyone who earns more than $100,000 in gross income per year will have the option to purchase additional coverage to increase their income replacement.

Enhanced Care will also provide a number of new benefits, including lump sum cash compensation of approximately $265,000 for anyone who suffers a catastrophic injury in a crash in addition to all of the care and recovery treatments you need, and new benefits for grief counselling and a caregiver to look after you.

These comprehensive benefits – whether for serious or life-altering injuries or to support you if you are off work – will, in every respect, result in better recovery outcomes for anyone injured in a crash. In fact, the medical and rehabilitation benefits will have no overall limit, which is a vast improvement over today’s limit of $300,000.

Importantly, you will choose your own doctor and health-care provider to lead your care, and they will work with ICBC to develop your customized recovery plan and get you back on the road to recovery.

To ensure Enhanced Care best reflects the care-based priorities and needs of all British Columbians, government and ICBC held more than 50 meetings between February and August 2020 through a mix of face-to-face and virtual sessions, along with receiving a number of written submissions. They consulted with members of the medical, healthcare, disability advocacy and road safety advocacy communities. A stakeholder report summarizing input provided by stakeholders during the consultation process explains how their feedback helped to develop and inform the final benefits and amounts.

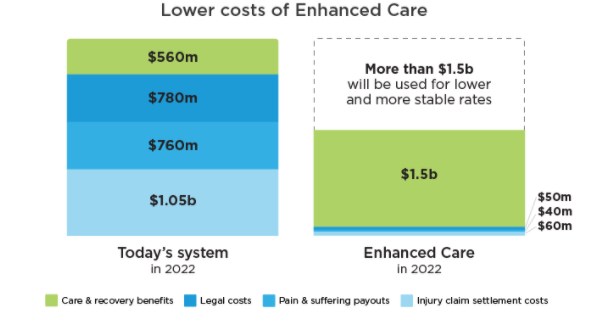

All of these changes to B.C.’s insurance system are possible because of the elimination of the significant costs associated with today’s litigation-based system. ICBC will apply those savings — more than $1.5 billion per year – toward lower, more stable insurance rates and better benefits for British Columbians injured in a crash.

Under Enhanced Care, in most cases, you won’t be able to sue the at-fault driver in a crash but, with no overall limit to the benefits available, you won’t need to. In addition to income replacement after a crash for the period of time you are unable to work, you’ll also have access to all the care you need, when you need it, for as long as you need it.

Notably, one thing that is not changing is that ICBC will still be holding accountable those drivers who drive dangerously and cause crashes. They’ll continue to pay more for their insurance — and the more crashes they cause, the more they’ll pay.

As well, crash victims will still have recourse through the courts to hold the most dangerous and negligent drivers accountable. For example, if you’re in a crash caused by a driver who’s convicted of impaired driving, you’ll still have the right to sue that driver in a civil claim for certain damages.

While many changes are coming to auto insurance in B.C. on May 1, plenty of ICBC transactions won’t change, including how you renew your policy through an Autoplan broker (whether in-person or by phone), report a claim online or by phone, and get an estimate and repair work underway if your vehicle is damaged. Looking ahead, you’ll also be able to renew your auto insurance online starting next spring.

To learn more about the Enhanced Care changes, visit icbc.com/enhancedcare. When it’s time to renew your insurance, ICBC’s province-wide network of Autoplan brokers are available to explain Enhanced Care and provide advice on what coverages are right for you.