March is Fraud Prevention Month. The Canadian Life and Health Insurance Association (CLHIA) has launched a Fraud=Fraud Program to help people across the country understand that health and dental benefits claim fraud is a real crime with real consequences.

Apart from the legal repercussions of a fraud conviction, Pacific Blue Cross recognizes that there are other “consequences” to benefits fraud and insurance abuse—and they have names. They’re the:

- son or daughter of a work colleague that needs extensive medical care,

- spouse that manages a chronic medical condition with an expensive drug,

- plan member who needs support with a mental illness

—all of whom are impacted as plan sponsors diligently try to balance benefit plan coverage and the rising cost of care to meet the needs of all plan members.

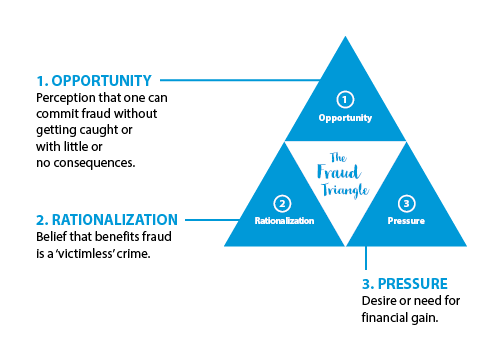

Benefits fraud and insurance abuse is not a victimless crime, despite some public belief to the contrary. Consider this: The CLHIA estimates the industry loses more than $600 million per year, resulting in higher premiums, reduced coverage for existing benefits, and even threatening long-term plan sustainability. It shouldn’t be socially acceptable to divert money away from enabling health care for the very people who need it most.

Pacific Blue Cross is committed to unwavering stewardship of health care value and affordability for their members and plan sponsors. As a result, they’ve invested millions of dollars in the right technology, people, and processes to detect fraud and insurance abuse, pursue problems when they find them, and prevent fraud from occurring in the first place.

Leading edge data analytics

Electronic benefits claims are on the rise. In the last three years, Pacific Blue Cross processed over 68.7 million claims, 86% of which were submitted online by members or BC service providers.

The ubiquitous use of e-claims necessitated a shift in their approach to minimizing fraud and insurance abuse and recovering monies lost on behalf of their clients.

In 2018, they implemented a state-of-the-art data analytics tool that relies on artificial intelligence, predictive analytics, link analysis, and machine learning to spot irregular billing patterns and claiming anomalies based on customized fraud use case scenarios (for instance, a dentist billing a root canal for a two-year-old).

“Every quarter we run several years of claims data through our tool to leverage the machine learning and intelligence aspects that identify fraud, insurance abuse, intentional misrepresentation, and unintentional errors,” says Suzanne Solven, Associate Vice President, Audit, Investigations, and Quality Assurance. “Risk scores are assigned to the results and investigations are prioritized based upon highest risk. This process focuses our resources on where they can generate the greatest recoveries for our clients. And it allows us to proactively deter potential fraud and insurance abuse situations before they become serious problems.”

The analytics tool is managed by an on-staff data scientist, which gives the Audit team flexibility in tackling new and creative ways people try and cheat the system.

A made-in-BC solution that saves plan sponsors money

For almost 80 years, Pacific Blue Cross has served British Columbian plan sponsors and members exclusively. This history gives them deep and abiding expertise in the BC health care system as well as strong partnerships with key players in the sector.

One such partnership is with BC PharmaCare. Pacific Blue Cross is the only benefits carrier that fully integrates with PharmaCare, which means they will not pay any claims (including additional drug mark-ups or other charges) if the PharmaCare program fully covers the cost of a drug.

The first big test of the data analytics tool was to audit pharmacies across the province, looking for instances where Pacific Blue Cross was “balance billed” for these particular PharmaCare claims. From April to June 2019 they performed over 1,000 pharmacy audits and were able to recover over $2 million in billing errors—a task that, with their old technology, would have taken the better part of 12 months to complete.

“This type of cost control measure is unique to Pacific Blue Cross,” says John Crawford, Chief Executive Officer. “We’ve made terrific strides towards our goal of being an industry leader for our zero-tolerance culture and strategic approach to eradicating fraud and insurance abuse.”

To learn more about how Pacific Blue Cross is approaching benefits fraud and insurance abuse, visit pacificbluecross.ca. The CLHIA’s Fraud=Fraud campaign can be found at https://www.clhia.ca/antifraud.

*Canadian Institute for Health Information National Health Expenditure Trends 1975 to 2019